Indian debt market : Settlement Guarantee Fund by the Limited Purpose Clearing Corporation (LPCC)

Introduction

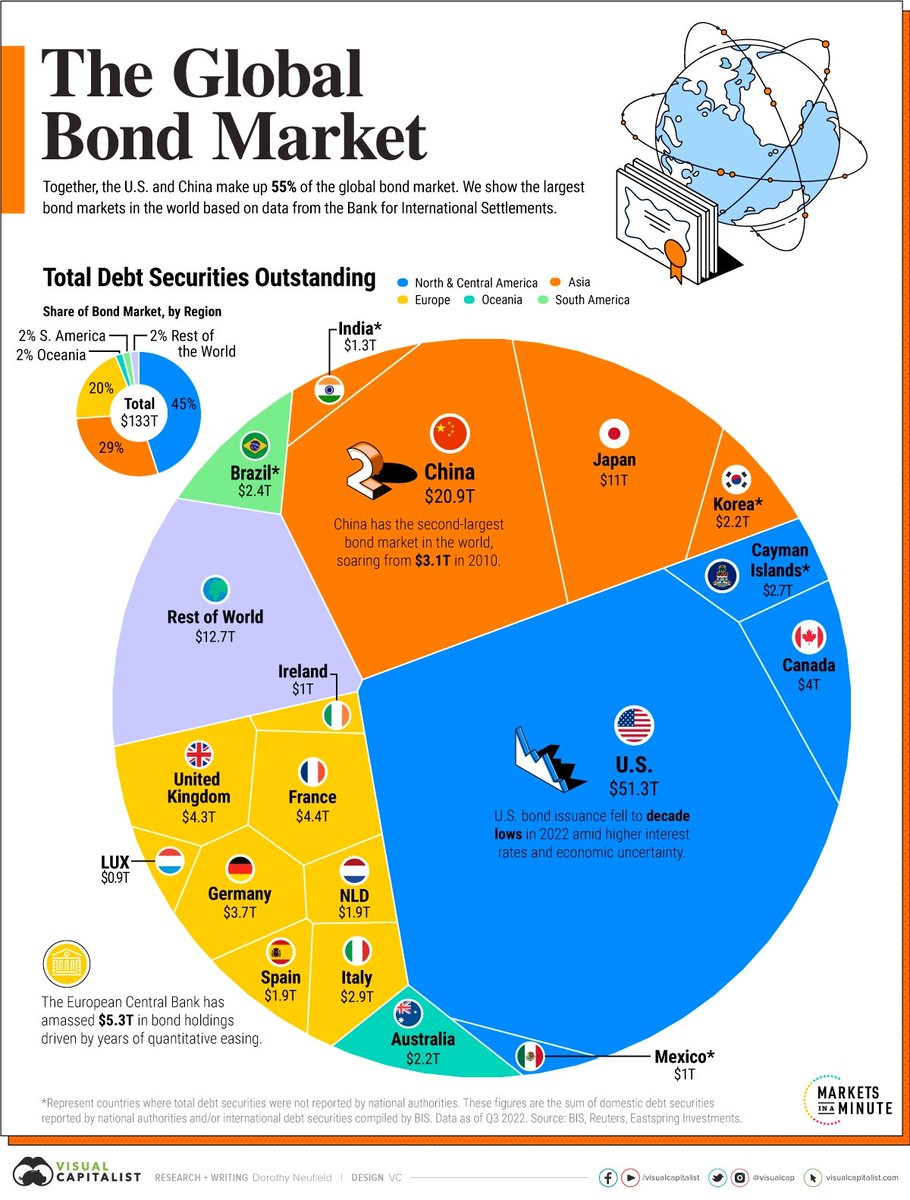

India’s economy has been growing steadily over the past few years and is now the fifth-largest economy in the world. However, despite contributing 8.7% to the global GDP, India’s bond market remains relatively small, accounting for only about 1% of the global bond market.

One of the major structural problems of our bond market is liquidity, which means it is difficult for market participants to buy or sell bonds without affecting their prices. Many times, investors have to sell their bonds in distress.

To address this issue, the Securities and Exchange Board of India (SEBI) has recently announced a new measure.

A Repo Market for Corporate Bonds

The answer to this problem is developing a repo market for corporate bonds to improve liquidity in India’s bond market. In a repo transaction, an investor pledges their securities (such as corporate bonds) with a lender and agrees to buy them back at a later date at a specified interest rate. This allows the investor to obtain liquidity without having to sell their holdings outright.

With this, investors will have access to short-term funding, which can help boost liquidity in the bond market. This will encourage more investors to participate in the market, as they will have greater flexibility in managing their investments. Overall, the introduction of a repo market for corporate bonds can contribute significantly to the development and growth of India’s bond market.

SEBI’s solution

To facilitate this, SEBI has recently announced a framework that includes the establishment of a Settlement Guarantee Fund by the Limited Purpose Clearing Corporation (LPCC). This fund will be used to clear and settle repo transactions in debt securities, thereby reducing the risks associated with such transactions. Market participants will be involved in building this fund, and eligible issuers of debt securities (i.e., companies that issue bonds) will be required to contribute 0.50 basis points (0.005%) of the yearly issuance value of bonds to this fund. The contribution will be mandatory, and issuers will have to deposit the required amount into an escrow account before issuing bonds.

This contribution will help build a robust settlement guarantee fund that can provide market participants with the confidence and security to participate in the repo market for corporate bonds.

How will it help?

While large and established companies can easily issue bonds with reasonable borrowing rates, smaller players face higher borrowing costs due to low liquidity. For example, suppose an issuer like XYZ Ltd. has a credit risk that should justify a borrowing rate of around 9%. In that case, they may end up having to issue the bond at a higher rate of 10% due to the low liquidity of their bonds. This is because investors would demand a liquidity risk premium, which is an additional cost added to the bond’s interest rate to compensate for the risk of holding a bond that is difficult to sell in the market. This liquidity risk premium increases the overall borrowing costs for issuers like XYZ Ltd. and may limit their ability to raise funds through the bond market.

The lack of liquidity in India’s bond market can make it challenging for smaller issuers to access funding at reasonable costs, which can hinder the growth and development of the market. That’s why this is a great move for the markets and will help solve one of our biggest structural problems – liquidity and also reduce these borrowing costs.

Link to the circular