Risk-Adjusted Returns: All You Need to Know

When put under a comparison bucket, you should compare investments and portfolios with comparable measurements; otherwise, the comparison does not give you a realistic picture.

This blog will deep-dive into the term risk-adjusted returns and understand three instruments that offer better risk-adjusted returns.

What are Risk-Adjusted Returns?

When you consider returns from any investment, you also think about the potential risk involved. You also subsequently calculate the net returns after deducting the risk percentage from them.

For example, if two different investment instruments give similar returns, but the risk involved varies, then you will prefer the instrument with less risk.

This means its risk-adjusted return is higher than the other instrument since they both provide the same returns.

In other words, when you calculate the profit made by your investment, after deducting the amount of risk involved, over the investment tenure, you are calculating the risk-adjusted return of your investment.

Importance of Risk-Adjusted Returns

Also Read: Equity Funds vs Debt Mutual Funds

1. Performance Measurement

Risk-adjusted returns cater to investors as an effective performance measurement tool that compares various investments and portfolios that have relatively similar features.

2. Volatility Check

Due to the involvement of the risk in determining returns, volatility is also considered while calculating risk-adjusted returns.

3. Index Alignment

Risk-adjusted returns enable an investor with index alignment analysis, where higher risk-adjusted returns are considered favorable.

4. Quality Testing

You can compare two different investments on an equal basis where the quality of the investment is considered an essential element of the outcome.

How to Calculate Risk-Adjusted Returns?

Broadly, there are two types of ratios through which you can calculate the risk-adjusted returns for an investment.

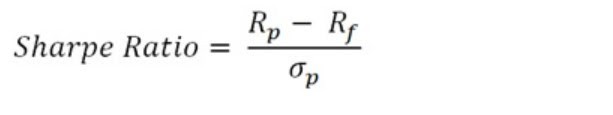

1. Sharpe Ratio

In this ratio, returns are adjusted with the risk-free rates of government securities to get the net risk-adjusted rate.

Sharpe ratio considers standard deviation to incorporate volatility in calculating the risk-adjusted returns.

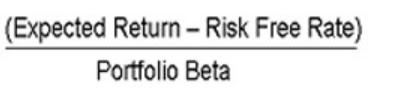

2. Treynor Ratio

Treynor Ratio is a mutual fund-specific ratio where it uses the fund’s beta to get risk-adjusted returns.

Investment Instruments Offering Risk-Adjusted Returns

The most popular investment instrument that offers a risk-adjusted return is a mutual fund.

Other instruments such as senior secured bonds and non-convertible debentures also offer such returns. Let’s have a closer look at these instruments to understand how they are calculated.

1. Mutual Funds

Mutual funds offer moderate-high returns and carry reasonable risk, based on the type of fund you invest in.

Mutual funds are suitable for investors who want to invest in equity but are sceptical about investing in direct stocks (because of the risk factor).

In which case, they can invest in equity or aggressive hybrid mutual funds, whose risk is lower than stocks. However, investors must note that all equity-related investment avenues have high risk.

Mutual funds have a benchmark or index to which it compares their performance. Alpha is a method to measure a mutual fund’s performance against the bar.

Similarly, beta considers volatility to give an idea of how risky those mutual funds are. Standard deviation is also typical to know how the returns vary from the average during a given period.

Also Read: Different Types of Mutual Funds in India

3. Non-Convertible Debentures (NCD)

NCDs are investment instruments that provide fixed-rate income to investors. Large companies raise capital by issuing convertible and non-convertible debentures. They also carry liquidity risk, since investors cannot withdraw their money before maturity.

NCDs offer relatively better returns, but they are typically unsecured and carry high credit risk.

Also Read: Sharpe Ratio: Meaning, Formula, Benefits and Other Important Points

You may question how senior secured bonds offer 9–11% risk-adjusted returns where other fixed-income instruments can barely touch that range. senior secured bonds are risky too, however, when we talk in the case of Wint Wealth, due diligence is done to try and reduce risk.

However, they involve three major types of risks: Credit Risk, fraud risk, and liquidity risk.

- Credit Risk: Involves the risk of an NBFC (issuer of bonds) defaulting to repay the invested amount or going bankrupt.

To mitigate this risk, Wint Wealth takes 1.2 times the collateral, in the form of vehicle loans, gold loans or even property loans, so that in case the NBFC defaults, they can use these loans to pay off the investors. - Liquidity Risk: This risk arises from the investor wanting to withdraw his or her money, but being unable to do so because the investment has a lock-in period (a period during which money cannot be withdrawn).

Generally, senior secured bonds have a maturity tenure ranging from 6 months to 24 months, during which investors cannot withdraw their money. However, it is possible to replace the investor with another one. But the company gives no such guarantees. - Fraud Risk: When an NBFC intentionally falsifies the collateral provided in the form of loans and defaults in repayment.

Also Read: Mutual Fund Cut-Off Time: What Is it & How It Affects Transactions?

Conclusion

Every investment will have a certain level of risk involved and no investment guarantees you returns.

However, with the necessary precautions, you can mitigate risk to make the most out of your investment.

Risk-adjusted returns, therefore, show how much returns an investment is generating for the investor, after incorporating all the risks.

Happy Winting!