Public Provident Fund (PPF): Introduction, Importance, Procedure, and Benefits

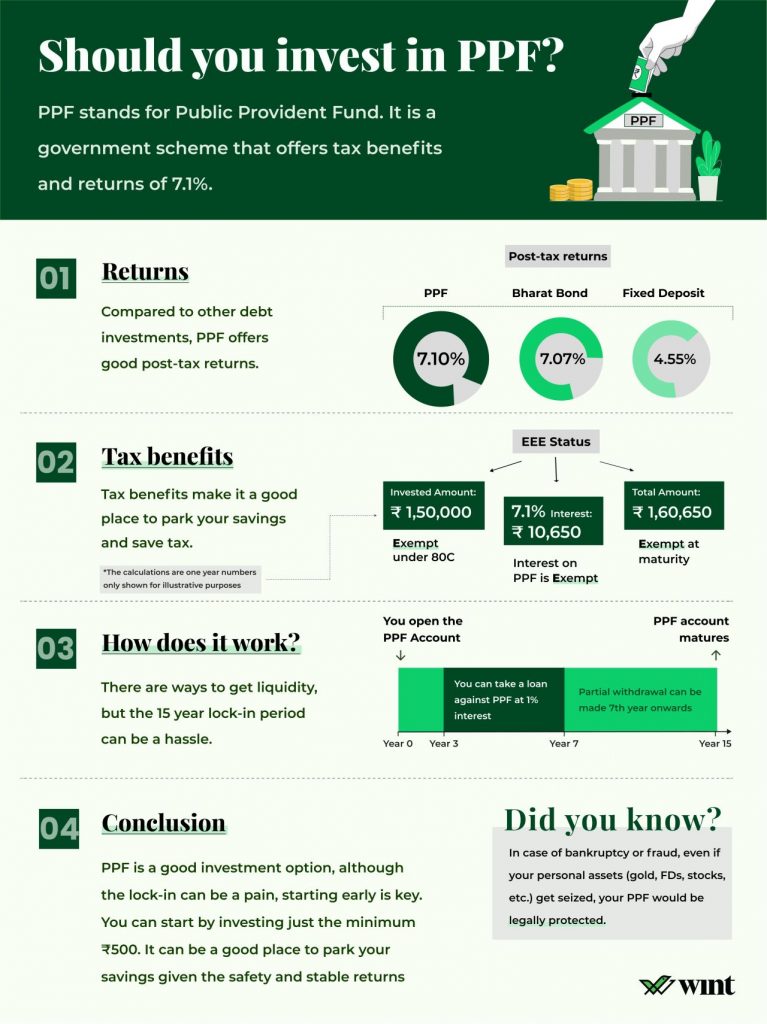

The Government of India (GOI) offers a slew of sovereign-backed investment schemes to enable long-term investment for its citizens. Among the many schemes, the Public Provident Fund (PPF), is designed to offer fixed returns, tax exemptions, and the safety of investments. While exploring different long-term investment options, you might consider opening a PPF account in a post office or an authorised national or private bank.

You can start saving and gaining interest in a Public Provident Fund account instead of letting funds sit idle in a savings bank account. This will not only instil a habit of savings but also provide returns in the long run. Furthermore, investing a certain amount every year in the Public Provident Fund can also help in portfolio diversification.

While you might have a basic understanding of what a Public Provident Fund account is, you should also be aware of the importance of having one and its benefits. We will answer each of these questions and explain the procedure to open and close a PPF account.

Let us explore each aspect of a PPF account.

What is a Public Provident Fund Account?

The Public Provident Fund (PPF) is a government-backed saving and tax-efficient investment scheme. Further, the investment is not market-linked so it offers guaranteed returns to protect the investment needs of people. To invest in the PPF scheme, you need to open a PPF account in a post office or an authorised national or private bank.

Key Features of Public Provident Fund (PPF) Account:

- Eligibility: Only Indian citizens are eligible to invest in PPF. One citizen can have only one PPF account. However, they can open another account on behalf of a minor. If there is any existing account of NRIs/HUF, it will remain active for a tenure of 15 years. But they cannot open new accounts.

- Investment Amount: The minimum investment amount for each financial year is Rs. 500 and the maximum investment amount is Rs. 1,50,000. The maximum limit by an individual shall be inclusive of the deposits made in their own account as well as on behalf of the minor.

- Investment Frequency: Earlier, you were only allowed to make a maximum of 12 instalments per year in your PPF account. However, the Government changed this rule in 2019 and now, you can deposit any number of times in one financial year up to a maximum amount of Rs, 1,50,000..

- Investment mode: Investments can be made via cash, cheque, Demand deposit or online transfer.

- Interest: The current PPF account interest rate is 7.1% per annum, compounded annually. Interest shall be credited to the investor’s account at the end of each year.

- Nomination: You have the option to nominate a nominee for your PPF account, either at the time of opening the account or subsequently.

- PPF Tenure: The mandatory PPF lock-in period is 15 years. You can withdraw the entire principal amount along with the interest amount after the completion of the tenure.

- Partial Withdrawals: Partial withdrawals are permitted after the completion of five years from the end of the financial year in which you open a PPF account. However, only one withdrawal is allowed in a financial year. The maximum amount allowed for withdrawal is only 50% of the PPF balance at the end of 4th year or 50% at the balance of the preceding year, whichever is lower can be withdrawn.

- Extension of PPF Account: You can choose to extend the account after 15 years without contributing to the PPF account. In this case, you will continue to earn interest until the account is closed. Alternatively, you can also opt for an account extension with contributions. This extension can be in blocks of five years, with no limit on the number of times you apply for extensions.

- Premature Closure: You are allowed to close a PPF account after the completion of five years from the end of the financial year in which you opened an account only in the following cases:

- You, your spouse, your parents or your dependent children suffer from a life-threatening disease or condition.

- You need to pay fees for the higher education of your dependent children or yourself.

- You become a non-resident of India.

All premature closures have a penalty of 1% interest which means interest in the account will be calculated at a rate which will be lower by one per cent. then the rate at which interest was being credited to the account from time to time

- Closure of account on the death of the account holder: In the event of the death of an account holder, the account will be closed, and the nominee or legal heir will not be allowed to deposit money into the account. Moreover, to close the account in case of death, the interest will be paid till the end of the previous month and the balance will be paid to the nominee or the legal heir.

- Tax Benefits of Public Provident Fund: The investments in the PPF scheme fall under the Exempt-Exempt-Exempt (EEE) category. It means that the deposits made in a PPF account, the interest earned every financial year, and redemptions will be deducted from the taxable income as per Section 80C of the Income Tax Act. You can make an investment of up to Rs. 1,50,000 every year in a PPF account to achieve tax exemption every financial year.

Also Read: Mutual Fund vs PPF-Which Is the Better Investment Instrument

Loan Against PPF

You may need a specific amount of money urgently. For example, to compensate for a loss in business or to make a down payment to buy a new vehicle. In these cases, you are not allowed to withdraw the balance accumulated in your PPF account. However, you can avail of a loan against your PPF account.

You are allowed to avail a loan of up to 25% of the balance amount the amount that stood to your credit at the end of the second year immediately preceding the year in which the loan is applied for. The loan facility against the PPF account is available for one year from the end of the financial year in which you opened the account, till the completion of five years from the initial investment. Please note that you can avail of only one loan in a financial year and you cannot avail of another loan until you repay the first loan entirely.

Public Provident Fund vs Tax-Saving Instruments

A PPF account differs from other tax-savings instruments in terms of its low-risk exposure and long lock-in period.

Also, most of the instruments can only be invested in by people over 18, but a PPF account can be created on behalf of minors as well.

The table below compares PPF with other investment instruments that enjoy tax rebates:

| Instrument | Risk | Lock-in | Interest |

| Public Provident Fund | Low | 15 years | 7.1% per annum |

| ELSS | Market- linked | 3 years | Market-linked |

| NPS | Market- linked | Till the age of 60 years | 9%-12% per annum (can be market-linked, depending upon where you choose to invest the capital) |

| Tax Saver FD | Low | 5 years | Up to 7% |

| NSC | Low | 5 years | 6.8% per annum |

| ULIP | Market-linked | 5 years | Market-linked |

| Sukanya Samriddhi Yojana | Low | 8 years | 7.6% per annum |

| SCSS | Low | 5 years | 7.4% per annum |

Also Read: How to Open a PPF Account for Minors?

How to Open a PPF Account?

To open a PPF account, you need to be either an Indian resident above the age of 18 or a guardian on behalf of a minor. There are two ways to open a PPF account, offline and online.

Offline procedure:

- You can open a PPF account at a post office or an authorised nationalised or private bank.

- Visit the nearest branch of a post office or a bank.

- Fill up the account opening application form.

- Submit one of the identity proofs such as an Aadhar card, PAN card, passport, voter ID, and others.

- Submit one of the residency proofs such as an Aadhar card, passport, and other documents as per the requirement.

- Submit your signature as proof.

- Along with the documents mentioned above, you need to submit the deposit amount.

Then, a PPF account will be opened through an offline method.

Read More: How to Open a PPF Account? All You Need to Know

Online procedure:

- Log in to your internet banking portal.

- Search for the option that enables you to open a PPF account.

- Choose between a self-account or a minor account, as per your preference.

- Fill in the nominee details, bank details, and other required details.

- Verify the details such as PAN card or Aadhar card.

- Insert the investment amount for each year. Then select whether the amount is to be deducted in instalments or in a lump sum.

- After selection, you will receive a one-time password (OTP) on your registered mobile number.

- Following the verification, your PPF account will be opened.

Some banks ask their customers to submit their know-your-customer (KYC) details along with the reference number at the nearest branch. Please follow the instructions accordingly.

How to Close a PPF Account?

To close a PPF account, you can submit the necessary documents at the branch of the financial organisation where you have the PPF account, choose the mode of withdrawal of the total balance, and close the account.

To withdraw the investments from PPF accounts, in part or in full, you need to submit Form-C to the bank or the branch where they have their account. Form C has three sections- basic details section, office use section and acknowledgement section. Along with the form, you also have to enclose the PPF passbook.

Also Read: Opening A Post Office Account Online

Who should invest in a PPF account

- Low-risk Appetite: Public Provident Fund is a long-term investment instrument for citizens with a low-risk appetite. You should consider investing in a PPF account if you need long-term returns after 15 years and do not wish to take risks with your investment.

- Looking for Portfolio Diversification: If you are diversifying your investment portfolio and exploring options that provide assured returns, you must open a PPF account and start investing. As the money invested in the PPF account is not further invested in market-linked schemes, the interest rate remains the same throughout the tenure. This, in turn, gives you assured returns upon maturity.

- Saving Taxes: Public Provident Fund investments fall under the Exempt – Exempt – Exempt (EEE) category. This means that the investments, interest and redemptions are all tax exempted. If you want to save tax, you can invest up to Rs. 1,50,000 in a PPF account in a single financial year.

Also Read: How to retire at the age of 40 in India?

PPF Withdrawal

At the maturity of a public provident fund, one can:

- Withdraw the entire amount completely.

- Extend the scheme without making new contributions. In this case, the interest on the deposit amount will continue to be compounded until the account is closed.

- Extend the scheme for 5 years with contributions. There is no limit to the number of times the PPF account can be extended.

Procedure for PPF Withdrawal

You can withdraw your amount from the PPF by submitting a duly filled “form G” to the concerned bank branch or post office. The form contains details of the PPF account and the bank account where you are transferring the withdrawn amount. Along with this, you will have to submit the PPF passbook as well.

Closing Thoughts

Opening a PPF account will be one of the best investment decisions you will make if you want to diversify your portfolio and save tax at the same time. Moreover, with a PPF, you can instil the habit of saving. However, you must cautiously make the decision about the investment amount as it will be locked for nearly 15 years, and you can withdraw a partial amount after five years from the date of account opening.

As you plan to become a long-term investor, PPF as an investment scheme presents one of the ideal options if you are exploring options that are safe, provide assured returns with a sovereign guarantee, and save tax.

FAQs

In which cases will a PPF account be discontinued?

If you do not deposit the predetermined investment amount in your PPF account throughout the financial year, it will be discontinued.

Is it possible to transfer a PPF account from one branch or post office to another?

Yes, the transfer facility for your PPF account from one branch or post office to another is available.

Can I open multiple PPF accounts?

No, you can only hold and operate one PPF account as per the regulations of the Public Provident Fund scheme.

Can I avail tax exemption if I make deposits into a PPF account for my child?

Tax exemptions are available for collective deposits up to Rs. 1,50,000. If you deposit Rs. 1,20,000 in your PPF account and Rs. 50,000 in your child’s PPF account, then you can claim deductions up to Rs. 1,50,000 only. The additional Rs. 20,000 will be considered taxable income.

Is it necessary to withdraw the accumulated money in my PPF account at the end of 15 years?

No, it is not mandatory. You can extend the tenure in blocks of five years upon maturity.

What are the interest rates and tenor for the loan availed under the PPF scheme?

You will have to pay the principal amount of the availed loan within 36 months from the first day of the month when the loan is disbursed.

After the principal amount of the loan is fully repaid, you will have to pay interest thereon in not more than two monthly instalments at the rate of one per cent per annum of the principal amount for the period till the complete repayment of principal was done