Post Office Sukanya Samriddhi Yojana: All You Need to Know

About Sukanya Samriddhi Yojana

The Post Office Sukanya Samriddhi Yojana (SSY) is a part of the Beti Bachao, Beti Padhao scheme that aims at developing a habit among parents to set aside some savings annually for their girl child/children. Under this Sukanya post office scheme, you can open an SSY account with a post office in your daughter’s name. The account comes with a fairly high-interest rate and tax benefits.

The goal is to enable the parents of a girl child to make available adequate financial resources for her education, right from the moment she is born. The Post Office Sukanya Samriddhi Yojana is an excellent tool for creating a corpus for your daughter’s education and career advancement.

In this blog, you’ll get all the details of Post Office Sukanya Samriddhi Yojana such as how to open an account online, interest rates, checking balance, documents, and more.

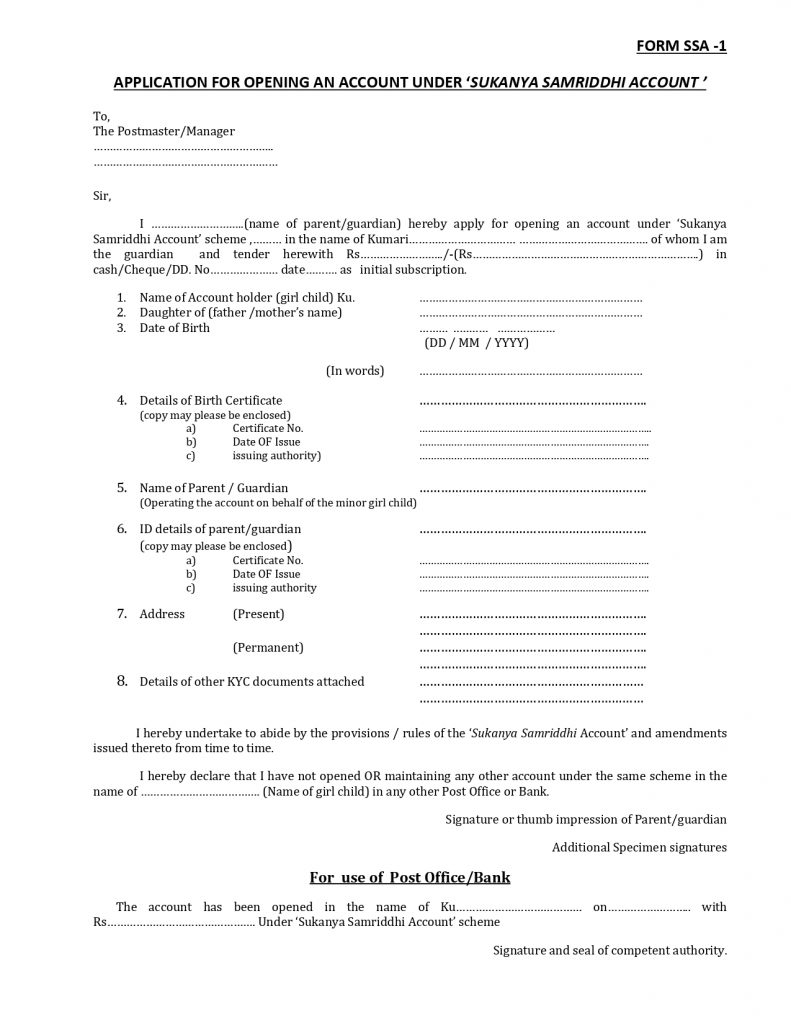

You can follow the below steps to open a Sukanya Samriddhi Yojana account with the post office:

- Request for a Sukanya Samriddhi Yojana form at the nearest post office or bank branch.

- Fill in the details along with submitting the following documents:

- Birth certificate of the girl child.

- Valid ID proof of the depositor.

- Valid address proof of the depositor.

- Passport-size photographs.

- In case you already have a savings account with the post office, you will have to share the details for the same.

- Pay the initial deposit amount, which can be anything between ₹250 and ₹1.5 lakh.

- After verification of the shared details, the SSY account will become active.

Also Read: 9 Sukanya Samriddhi Yojana Benefits Support India’s Girl Children

Features of Post Office Sukanya Samridhi Yojana

Let’s understand the features of the Sukanya Samriddhi Yojana in the post office:

Eligibility

- The account holder must be a girl child aged up to 10 years.

- The girl child should be a citizen and a resident of India until the account matures.

- Only biological parents or legal guardians are allowed to open the account.

- Each girl child can have one account in her name.

- One family can have at most two SSY accounts. This condition is waived in the case of twins/triplets.

Interest rate

A fixed interest rate is paid on the deposit amount under the SSY scheme. This rate is revised annually by the government of India. The current interest rate on SSY accounts is 8.2% for Quarter 4 of FY 2023-24.

The lowest amount in the account between the end of the fifth day and the end of the month is used to compute the interest on the Post Office Sukanya Samriddhi Yojana. This account features annual compounding. The account will nevertheless be credited with the real interest amount at the conclusion of each fiscal year.

Tenure

The account has a term of 21 years from the date of opening. Once this period is over, the account doesn’t accrue any interest on it. Deposits to this account have to be made for a period of 15 years only. After the lapse of the 15th year, it earns interest on auto-pilot for the rest of the tenure.

Also Read: Opening A Post Office Account Online

Minimum and maximum investment amounts

A minimum of ₹250 has to be deposited annually in the account to ensure that it remains active. In the case of non-payment, it becomes inactive, and you have to pay a penalty of Rs. 50 along with depositing the missed amount to activate it again.

Only up to ₹1.5 lakhs can be deposited per annum into the account. Any amount deposited that is more than that will not earn any interest and will be available for withdrawal.

Documents required for Sukanya Samriddhi Yojana

To open an SSY account you will need the following documents;

- The birth certificate of the girl child.

- Proof of identity and address, for the guardian.

- A medical certificate as evidence if there are girl children born in an order of birth.

- Additional KYC documents, such as Aadhaar card, Voters ID, etc.

- Any other documents that may be required by the post office or banks.

Please note that you must provide copies of all these documents, at the post office or bank branch where you have submitted your SSY application.

Sukanya Samriddhi Yojana online payment

- Download the post office app on your smartphone.

- Transfer money from your bank account to your account.

- Open the DOP Products section within the app. Select the Sukanya Samriddhi Yojana account option.

- Enter your SSY account number along with the DOP customer ID.

- Specify the amount you want to pay and choose the duration, for installment payments.

- Set up a payment routine according to your preferences.

- You will receive notifications confirming setup of the payment routine.

- Every time a money transfer is made through the app you will be notified accordingly.

You also have an option to set up standing instructions allowing a specific amount to be regularly transferred online to your SSY account.

Tax benefits

The amount deposited under the Post Office Sukanya Samriddhi Yojana comes under the Exempt-Exempt-Exempt (EEE) category. That means investments of up to ₹1.5 lakhs are exempt under section 80-C of the IT Act, 1902. The interest earned on this income and even the withdrawn amount (on maturity) is tax-free.

Sukanya Samriddhi Yojana Application Form

Withdrawal Rules for Sukanya Samriddhi Yojana

The child can prematurely withdraw from the account in the following situations:

- If she is married or getting married after the age of 18, she can withdraw her amount by submitting the request at least one month before or up to three months prior to the wedding. She will have to submit proof of age to do so.

- If she has attained 18 years of age, completed class 10th and wants to pursue higher education, she can withdraw prematurely from the account by providing the relevant documents.

- If she completes her class 10th exam before attaining the age of 18, her parents can withdraw from the SSY account for her higher studies.

In each of the above cases, an amount of up to 50% of the account balance at the end of the previous financial year can be withdrawn.

Note that parents can only withdraw from the account if the child has completed class 10th before attaining the age of 18. In other cases, the child herself has to make the withdrawal.

Account closure

Closure of SSY Account upon maturity

- An SSY account reaches its maturity after 21 years, from the date of the birth of the girl child.

- To close the account upon maturity the girl child needs to submit an application along with proof of identity, residence and citizenship documents.

- Upon closure the entire balance in the SSY account including any accrued interest will be paid to the girl child.

Premature closure conditions

- Premature closure of an SSY account is permitted under circumstances:

- Marriage – The girl child should be 18 years old and needs to submit an application between one month prior to marriage and three months after marriage. It is essential to provide age proof documents along with the application.

- Death – In case of demise of the girl child her guardian must furnish a death certificate. The remaining balance in the SSY account including interest earned will be paid to the guardian.

- Medical Treatment – Premature closure may be allowed if there is a life threatening disease affecting the girl child or in case of demise of her guardian.

- Change in status – If there is a change in residency or citizenship status where the girl child becomes a resident or non citizen of India it is mandatory, for either the girl child or her guardian to notify this change within one month. Subsequently premature closure may be considered.

- If the post office or bank determines that keeping or continuing the SSY account is causing hardship, for the girl child such as when the guardian passes away or due to reasons the girl child or guardian can request an early closure of the account.

In case of closure for any reason the entire deposit will only earn an interest rate applicable to a regular savings account, at the post office. Please note that closing an SSY account before its maturity is not advisable as it can potentially reduce the investments returns. However there may be situations where early closure becomes necessary.

Sukanya Samriddhi Yojana Benefits

The aim of the Post Office Sukanya Samriddhi Yojana is to empower girls in the country. It comes with various benefits to encourage its use:

- Corpus for a child when she comes of age

The Post Office Sukanya Samriddhi Yojana with the post office leads to the creation of a corpus for the girl child available for use when she comes of age. It can be used for her wedding expenses or her education. This tries to empower girls and their parents financially. - High rate of interest

The rate of interest paid on the deposits in the SSY account is fairly high and even higher than the prevailing PPF rate. This high-interest rate is especially attractive for investors with a very low-risk appetite. - Convenient and transferable

Opening the Post Office Sukanya Samriddhi Yojana account with the post office is hassle-free and convenient. There is also an option to relocate it to a different post office branch in case of a change in residence. You can also transfer it to a bank branch conveniently. - Risk-free Returns

Sukanya Samriddhi Yojana is a government-backed scheme. This means your investment is safe and will grow over time, even if the market performs poorly. The government of India guarantees the minimum interest rate on deposits, and the principal amount is also guaranteed. This means that you cannot lose money on your investment, even if the interest rate falls to zero.

Please note that one cannot open an SSY account with the post office online as of yet.

Also Read: Post Office Scheme for Women

Tax benefits

As you have seen above, the deposits under the scheme are exempt from paying taxes as per section 80C of the Income Tax Act. Therefore, the return on the scheme also includes the taxes saved, making it a high-return scheme. SSY falls in the EEE category, that is, the amount invested (up to Rs. 1.5 lakhs), the interest earned and the final withdrawal amount are all tax-exempt.

Read More: Know how to get the SSY Passbook Online

Final Thoughts

You have seen the features and benefits of the Post Office Sukanya Samriddhi Yojana at the post office. You have also seen how to open an account with a bank or post office branch. The scheme is a great way to save for your child in a disciplined fashion. It ensures that you have a corpus ready by the time she comes of age and requires funds for higher education or her wedding.

The high rate of interest, ease of account opening, and tax benefits have made it an attractive investment option. So, save for your child and give her the future that her country wants her to have!

FAQs

Who can open an account under the Post Office Sukanya Samriddhi Yojana?

Any parent or legal guardian can open an account under the Sukanya Samriddhi Yojana on behalf of their girl child aged <10 years. However, there is a limit of 2 accounts per family. This restriction is however waived off in the case of twins/triplets.

What happens to the account in the event of the death of the girl child?

In the event of the child’s death, the account is closed, and the proceeds are transferred to the parent/legal guardian on submission of the certificate of death.

What happens to the account in the event of the death of the account holder before the child comes of age?

In the event of the death of the depositor, the account can be closed and proceeds transferred to the family/ girl child. It can also be kept as it is and made to accrue interest till maturity.

How many accounts can you open for one child?

You can only have one account per child. One family can have at most two accounts for two female children. However, this condition is relaxed in the case of twins or triplets born after the first single child.

Can I open a Post Office I account online?

No. Currently, there is no provision to enable the online opening of the SSY account.

Can I have both a PPF account and a Post Office Sukanya Samriddhi Yojana account for my daughter?

Yes. You can have both accounts, but the tax exemption limit is ₹1.5 lakhs deposited in both accounts combined.

Can I avail of a loan against my SSY account?

No, there is no provision to take a loan against the SSY account.

Can I invest 10 lakhs in Sukanya Samriddhi Yojana in a single year?

No, you cannot invest more than ₹1.5 lakhs can be deposited per annum.

Do we need to pay any tax on the maturity amount of Sukanya post office yojana?

No, you don’t need to pay any tax on the maturity amount of Sukanya Post Office Yojana.

What is the penalty if I could not deposit the minimum amount in the Sukanya Yojana?

A minimum deposit of ₹250 has to be deposited annually in the account to ensure that it remains active. In the case of non-payment, it becomes inactive, and you have to pay a penalty of ₹50 along with depositing the missed amount to activate it again.

Can we take loan against the Post Office Sukanya Samriddhi Yojana?

No, you cannot take a loan against the Post Office Sukanya Samriddhi Yojana. The SSY scheme is a small savings scheme designed to benefit Indian girl child, and it does not allow for loans to be taken against the account balance.

What are the disadvantages of the SSY scheme?

Long Lock-in Period: The SSY scheme has 21 years maturity period from account opening, which makes it quite illiquid. This means that except for some cases like, death of the account holder or the girl child’s marriage or higher education, you cannot withdraw the money before the maturity date. The funds are locked in until the girl reaches the age of 18, with only 50% available for higher education.

Maximum deposit limit: The SSY scheme has a maximum deposit limit of Rs. 1.5 lakh annually which may not be enough for some parents who want to save a larger corpus for their daughter’s future.

Premature withdrawal penalty: If you withdraw money from the SSY account before the maturity date, you will have to pay a penalty of 50% of the interest earned on the account balance.

No loan facility: You cannot take a loan against the SSY account balance. This can be a problem if you need money for an emergency.

Interest rate risk: The interest rate on the SSY scheme is changeable on a quarterly basis. This may not be enough to combat the rising education and marriage expenses.

What is the current Interest rate offered in Sukanya Samriddhi Yojana (SSY) ?

The current interest rate on SSY accounts is 8.2% for Quarter 4 of FY 2023-24.