Which NBFCs Does Wint Wealth Choose to Work With?

As we are talking to more and more users, a common question that comes across is how do you guys choose the NBFCs? As these are not branded NBFCs like Bajaj, Mahindra, etc. The question is valid.

How do we choose the NBFCs to work with?

Well, we call it magic sauce, but we are not KFC/ Coca-cola to hold onto the secret formula. Instead, we want our users to know what we do, how we do and why we do it when we do something.

Therefore, we decided to write a series of posts on how we choose the NBFCs.

By now, you would know our core investment philosophy:

- Fixed/ Steady/ Predictable returns.

- Secured by receivables

Now, would we do every asset that falls under this?

Obviously Not! There are many more filters!

We make sure that all deals are bankruptcy protected. However, we will work only with NBFCs, which we think will not go bankrupt.

If NBFC runs smoothly, the money is going to flow back smoothly. So how do we judge whether NBFC has a higher/lower chance of going bankrupt?

The first thing we check is leverage. What is the leverage? How is leverage calculated?

Leverage = Debt/equity.

An NBFC has a 1000 Cr Loan book, and it has equity of 250 Cr. it means NBFC has taken 750 Cr debt.

In the above case, leverage is 750/250 = 3.

Why is Leverage Important?

Any sudden event may cause some losses to NBFCs. In such cases, the equity absorbs the loss. Thus, it acts as a cushion or shock absorber.

If leverage is less, NBFC would lose some equity but survive the loss.

If leverage is high, then losses can wipe out the equity, and NBFC would go bankrupt. Consider an event like covid, which causes, say, 5% losses across all NBFCs.

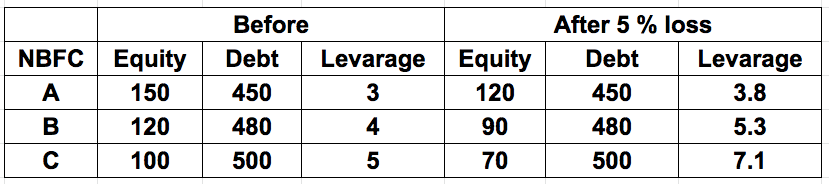

There are three NBFCs with 600 Cr loan books but different leverages: 3,4,5

Notice how if the leverage is already high, after a 5 % loss, it increases dramatically.

Note that NBFC can have a maximum of 5.66 leverage. If NBFC goes beyond 5.66 leverage, RBI will intervene, and NBFC may lose the license and have to shut down the business.

So as a safe side, we work with NBFCs with a leverage of 4 or less.

Beyond 4, it becomes too risky for our style. 3–3.5 is our sweet spot, and less than 3 is a party!

Our next deal is going live this Wednesday( 23rd Dec). It is a gold loan portfolio of NBFC named KanakaDurga. KanakaDurga has a leverage of 3.4.

So leverage is the first filter that we use. Then what’s our next filter?

The next thing we check is whether the data and numbers reported by the NBFC are accurate and how are reporting practices of the NBFCs on an on-going basis.

Our audit team makes on-ground visits to NBFC branches, some borrowers to check the data accuracy and does thorough due diligence.

But there is one more important factor that we consider: external institutional investors and their quality. Why does it matter?

These investors put considerable equity in the NBFC and have control over many things NBFCs do. When they put in money, it changes how the NBFC functions, reports data and handles business processes.

So we work with only those NBFCs which have quality institutional investors.

Also Read: 15 Best Mutual Fund Houses in India

Their Presence Changes Three Major Things

1. Deep Due Diligence

Such investors probably make 2 to 4 investments per year. Therefore, before investing, they conduct deep due diligence of these NBFCs. This diligence often goes for 3–4 months, and checks for all processes, market feedback, underwriting policies, business practices, compliance checks, etc.

Preparing for such due diligence takes more than a year as NBFCs have to train their people and set up proper processes. And its sets up good reporting practices. We have seen a couple of times where institutional investors did not invest because the NBFC failed the due diligence.

2. Board Presence

When these institutional investors invest, they often take a board seat. The Board of directors has the ultimate power to run the company. As these investors are there on the Board of the company, there is a proper governance structure. In such a case, the promoters cannot make arbitrary decisions outside the agreed framework.

That provides huge stability to NBFCs. Plus, these investors also make sure that the NBFCs have good quality auditors. If not, they appoint renowned auditors. Such auditors check the data, numbers reported by NBFC very deeply and make sure there is no misreporting.

For example, Kogta Financial has Deloitte as its auditors, one of the top/ big four auditing firms.

3. Deep Pockets

Obviously, these investors have deep pockets. If required, they can put more money through equity into these companies to stabilize the NBFC and grow.

Suppose a covid like event happens, which increases the losses; in these cases, investors can pump in money and make the NBFC stable.

We have seen many NBFCs raising money from their existing equity investors in the last year.

Furthermore, such deep-pocketed investors also give comfort to other lenders like banks. So once the quality investors invest equity into NBFCs, new lenders become more aggressive in lending money to the NBFC, making NBFC more profitable and stable.

Given the above three reasons, we believe for us to work with NBFC, it is a must that they have quality institutional investors.

So we have seen why leverage matters. Now we saw how quality investors matter.

In addition to the above, the liability profile of NBFCs, i.e., the presence of existing lenders, is also a necessary check for us.

Lenders are people/companies/institutions that give funds to the NBFC.

Now there are three key components when we look at the Liability Profile.

Key Components of Liability profile

The components are as follows:

1. Number of Existing Lenders:

Here, we look at the number of lenders that an NBFC already has. Many lenders would mean that an NBFC has been analyzed various times and has passed the filters.

The previous NBFCs we worked with, i.e., Kogta and Kanakdurga, had more than twenty-five lenders.

Other benefits of more lenders v/s fewer Lenders?

Let’s say there are 2 NBFCs: Baburao NBFC and Govinda NBFC.

Baburao has 5 lenders, Govinda has 20 lenders.

As Baburao depends on five lenders for funding, what if one of the lenders denies further financing?

Baburao’s 20% business is at risk.

Whereas, in Govinda, even if one of the lenders denies funding, a minimal amount of business will be at risk as the numbers of lenders are high.

Having a high number of lenders will not constrain you to be dependent on a single entity for growth.

2. Quality of Lenders

While having a high number of lenders is a good sign having a good quality of Lenders is also necessary.

Suppose Govinda has Lenders like Mutual Funds, Banks, Global Companies, whereas Baburao has Lenders like other smaller NBFCs; the former gives more comfort and validation.

Thus, the funding profile should be evaluated based not only on the quantity of Lenders but also on the quality of lenders.

3. Diversification of Lenders

Suppose an NBFC has the bulk of its borrowings from various mutual funds. Here, even if one Mutual Fund house stops lending money to the NBFC, the other Mutual Fund Houses may also stop.

Different lenders from the same category tend to behave similarly. Hence having lenders from different categories like banks, mutual funds, foreign investors, NBFCs, and retail investors is a plus point and reduces the risks.

We work with NBFCs and structure the instrument to offer 9–11% fixed returns. Wint Wealth mitigates the risks by exhaustive due diligence, auditing, and bringing instruments like Senior Secured bonds.

Happy Winting!