Navi Finserv Limited July 2023 NCD Public Issue Review

About the Issue

Navi Finserv Limited is launching its public issue of NCDs to raise funds from the debt market. Read further to know more about the business of Navi Finserv.

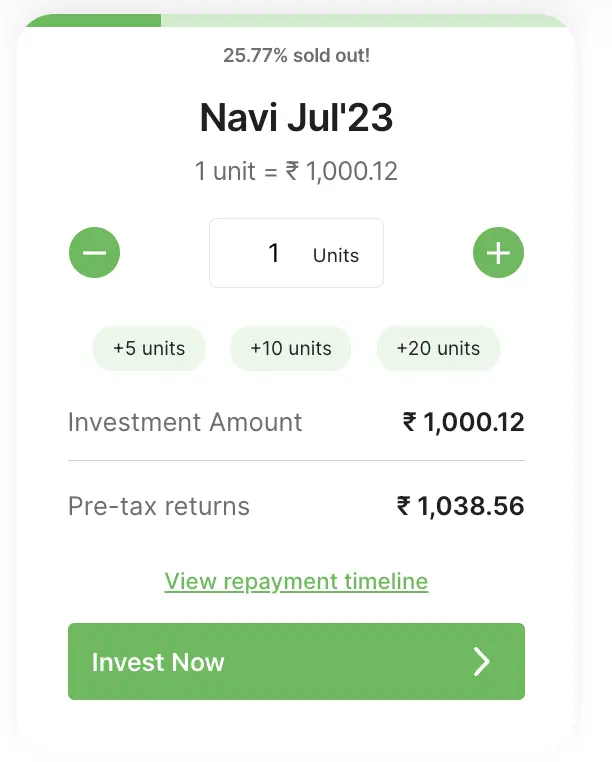

| Issuer | Navi Finserv Limited |

|---|---|

| Type of Instrument | Rated, Secured, Listed, Redeemable, Non-Convertible Debentures |

| Issue Size (Tranche I) | Rs. 250 crs (Base Issue) + Rs. 250 crs (Over Subscription) |

| Face Value | Rs. 1,000 |

| Tenure | 18 months to 36 months across Series I-V |

| Yield | 10.18% to 11.01% across Series I-V |

| Application size | Minimum Rs. 10,000/- (10 NCDs) and in multiples of 1 NCD thereafter |

| Security Cover | Minimum 100% security cover or higher on the principal outstanding plus interest thereon |

| Credit Rating | CRISIL A/Stable & IND A/Stable |

| Issue Open Date | 10-Jul-2023 |

| Issue Close Date | 21-Jul-2023 |

The principal terms of each option of NCDs are set out below

| Series 1 | Series 2 | Series 3 | Series 4 | Series 5 | |

|---|---|---|---|---|---|

| Frequency of Interest Payment | Monthly | Monthly | Annual | Monthly | Annual |

| Nature of Instruments | Secured NCDs | ||||

| Tenor | 18 months | 27 months | 27 months | 36 months | 36 months |

| Coupon (% per Annum) | 9.75% | 10.25% | 10.75% | 10.50% | 11.02% |

| Effective Yield (% per Annum) | 10.18% | 10.73% | 10.78% | 11.01% | 11.01% |

About Navi Finserv Limited

Navi Finserv Limited was originally incorporated in the year 2012 as Chaitanya Rural Intermediation Development Services Private Limited. The promoter, Navi Technologies acquired control of the company in 2019, and officially renamed it to Navi Finserv Private Limited in 2020 and then changed to Navi Finserv Limited in 2022. It is classified as a systemically important NBFC.

Invest in Navi Finserv 5 month tenor bond ?

Navi Finserv Limited offers lending products like digital personal loans and home loans under the “Navi” brand. The company also offers microfinance loans, under the “Chaitanya” brand through their Subsidiary, Chaitanya India Fin Credit Private Limited (CIFCPL). During the financial year ended March 31, 2023, the company disbursed 1,870,683 personal loans amounting to ₹ 115,004.11 million, with an average ticket size of ₹61,477, covering over 96% of all Indian pin codes. Since the launch of home loans in February 2021, 1,938 loans were disbursed with an average ticket size of ₹6.45 million during the financial year ended March 31, 2023.

About Navi Technologies Limited

Navi Technologies Limited (NTL) is a technology-driven financial products and services company in India focusing on the digitally connected young middle-class population of India. The company owns and operates through an online app ‘Navi’. Incorporated in 2018, the company sells financial products like loans, health insurance and mutual funds.

Mr. Sachin Bansal, the former co-founder of Flipkart presently holds about 98% stake in Navi Technologies Limited (NTL) which, in turn, holds 100% of Navi Finserv Limited (NFL). Navi Finserv in turn held 100% of its subsidiary, Chaitanya India Fin Credit Private Limited (CIFCPL) and recently sold 25% to NTL in March 2023.

Digital Retail Lending

India has a smaller credit penetration compared to USA and China and its retail lending AUM stands at approximately US$ 608 billion with less than 10% of the retail loans being disbursed digitally. According to RedSeer, the financial services space in India is highly underpenetrated (across segments including lending) which presents a big opportunity for a technology-first company to capture a large market share.

India’s bank retail lending AUM has grown at a CAGR of 16% between financial years 2016 and 2022 with housing loans being the largest, and personal loans and credit cards growing the fastest. Personal loans and home loans have shown a CAGR of 15% and 12%, respectively in the last five years.

The NBFC retail lending AUM in India has grown at a CAGR of 27% during financial years 2016 to 2022 to reach approximately US$ 125 Billion. The major contributors to this growth were personal loans and home loans growing at a CAGR of 32% and 23% respectively. Despite posting strong growth, India’s Formal Retail Credit Penetration remains significantly lower than global peers indicating a large headroom and potential for growth.

Among the retail lending categories, personal loan has grown the fastest and is estimated to grow at a CAGR of 27% over the next five years. The new loan disbursals for the personal loan category are estimated to increase at CAGR of 27% from US$ 50 billion in the financial year 2021 to US$ 164 billion in the financial year 2026. In the same period, overall digital lending is estimated to increase from 19% to 41% of the total personal loan disbursals.

RedSeer estimates that the digital lending market in the personal loan, home loan and loan against property (LAP) categories will grow at a CAGR of 48% to become a market of US$ 107 billion in the financial year 2026 with personal loans carrying the highest share of 63% in the digital lending market followed by a 31% digital disbursal share of home loans and 6% for LAP.

Company Financials (Standalone)

| Particulars | FY23 | FY22 | FY21 |

|---|---|---|---|

| Net Worth (₹ in Cr) | 2,191.92 | 1,185.26 | 1,152.60 |

| Borrowings (₹ in Cr) | 5,762.63 | 2,822.68 | 2,086.49 |

| AUM (₹ in Cr) | 6,369.51 | 2,791.44 | 529.35 |

| PAT (₹ in Cr) | 171.99 | -66.91 | 97.54 |

| PAT Margin | 12.49% | -14.55% | 28.97% |

| GNPA | 1.70% | 0.87% | 4.46% |

| NNPA | 0.30% | 0.04% | 0.45% |

| Debt to Equity | 2.54 | 2.39 | 1.81 |

| CRAR | 28.37% | 30.73% | 38.04% |

| Tier I Capital | 27.19% | 29.73% | 36.56% |

| Tier II Capital | 1.18% | 1.00% | 1.48% |

The company’s leverage is 2.54x as of FY 2023, resulting in a moderate CRAR of 28.37%, which is at controllable levels. As per the offer details, the post-issue leverage is expected to increase further to 2.76x at a standalone level. At a consolidated level, the leverage is 3.78x. The AUM has seen strong growth of 1,203% since FY21.

Navi Finserv’s subsidiary, CIFCPL as of March 2023, had low GNPA and NNPA of 0.28% and 0.05%, respectively. The company’s CRAR is 22.34%.

Company Financials (Consolidated)

| Particulars | FY23 | FY22 | FY21 |

|---|---|---|---|

| Net Worth (₹ in Cr) | 2,439.23 | 1,259.09 | 1,176.09 |

| Borrowings (₹ in Cr) | 9,225.15 | 4,862.65 | 3,113.70 |

| AUM (₹ in Cr) | 10,150.14 | 5001.41 | 1661.29 |

| PAT (₹ in Cr) | 264.16 | -14.66 | 118.17 |

| PAT Margin | 12.70% | -1.79% | 20.91% |

| Debt to Equity | 3.78 | 3.86 | 2.64 |

Borrowings

| Nature of Borrowings | Amount (₹ in Cr) | % |

|---|---|---|

| Secured | 5,112.61 | 88.72 |

| Unsecured | 650.02 | 11.28 |

| Total | 5,762.63 | 100.00 |

The Top 10 Term Loan Lenders (March 2023)

| Name | Amount Outstanding (₹ in Cr) | % Of Total Debt |

|---|---|---|

| State Bank of India | 263.31 | 14.97 |

| HDFC Bank Limited | 176.06 | 10.01 |

| IDFC First Bank Limited | 176.10 | 10.01 |

| Yes Bank Limited | 91.29 | 5.19 |

| MAS Financial Services Limited | 88.02 | 5.00 |

| Axis Bank Limited | 80.55 | 4.58 |

| Kiset su Saison Finance (India) Private Limited (Credit Saison India) | 77.95 | 4.43 |

| Mahindra and Mahindra Financial Services | 74.92 | 4.26 |

| Hinduja Leyland Finance Limited | 70.07 | 3.98 |

| Jana Small Finance Bank | 59.68 | 3.39 |

Peer Comparison (March 2023)

| Particulars | Navi Finserv | Krazybee |

|---|---|---|

| AUM (₹ in Cr) | 6,369.51 | 2,318.32 |

| GNPA | 1.70% | 2.29% |

| NNPA | 0.30% | 0.85% |

| Net Worth (₹ in Cr) | 2,191.92 | 1,589.15 |

| Debt to Equity | 2.54 | 0.81 |

| PAT (₹ in Cr) | 171.99 | 65.09 |

| PAT margin | 12.49% | 9.05% |

| Rating Agency | Navi Finserv | Krazybee |

|---|---|---|

| CRISIL | A/Stable | BBB+/Stable |

Comforts

- Comfortable asset quality with GNPA and NNPA at 1.70% and 0.30%.

- Well capitalized, having a net worth of more than ₹ 2000 Crore with CRAR of 28.37%.

- Diversified set of lenders – HDFC Bank, SBI, ICICI Bank, Kotak Mahindra Bank, etc.

Concerns

- The company’s portfolio is highly concentrated in unsecured space with personal loans forming ~90% of AUM.

- The majority of Navi’s portfolio has been built recently. The performance of the loan portfolio over multiple business cycles is yet to be seen.