Long Call Condor Options Strategy

Long Call Condor is a multi-leg options strategy that involves buying a lower and higher call and selling two different strikes of options in between. This non-directional strategy benefits from slow and steady movement between the underlying asset’s upper and lower price ranges.

This strategy demands low volatility and price fluctuations in the underlying assets. Opposing it may result in loss, but defined. The long-call condor options strategy is best for those conservative traders who want a non-directional strategy with limited risk.

What is Long Call Condor Options Strategy?

This four-legged options strategy consists of buying a lower strike ITM call and selling a higher strike ITM call than the one bought, selling an OTM call and buying another OTM call at a higher strike price. This strategy is a net debit spread where the premium paid is more than the premium received.

When To Initiate a Short Call Condor Options Strategy?

This four-legged options strategy consists of buying a lower strike ITM call and selling a higher strike ITM call than the one bought, selling an OTM call and buying another OTM call at a higher strike price. This strategy is a net debit spread where the premium paid is more than the premium received.

Long call condor is a risk defined strategy with capped profit. The strategy profits maximum when the underlying asset trades between two strikes of sold call options. The loss is limited to the amount of premium paid. Ideal scenario is to trade the long call condor when the volatility drops and markets are in range bound or neutral.

How to use Long Call Condor Options Strategy?

The table below shows different strikes of Nifty50 Index options having the same expiration. This table’s contents has been discussed below for further analysis of Long Call Condor Options Strategy.

Assuming the Nifty50 index trading at 17800 levels and its options strike price At The Money.

| Strike Price | Options Price | Types of Options |

| 17650 | ₹400 | In The Money |

| 17700 | ₹350 | In The Money |

| 17750 | ₹280 | In The Money |

| 17800 | ₹150 | At The Money |

| 17850 | ₹100 | Out of The Money |

| 17900 | ₹60 | Out of The Money |

| 17950 | ₹25 | Out of The Money |

Motive of this strategy is to gain from low volatility and neutral price movement in the Nifty50 index. Assuming this scenario, one can choose strikes from the table above.

- Buy one In The Money Strike Call 17700 (ITM) at ₹350

- Sell one In The Money Strike Call 17750 (ITM) at ₹280

- Sell one Out of The Money Strike Call 17850 (OTM) at ₹100

- Buy one Out of The Money Strike Call 17900 (OTM) at ₹60

The spread in this strategy will become net debit; the premiums paid here are higher than premiums received.

Choosing Strike Price

Assuming Nifty50 is trading at 17800, expecting low volatility and a reduction in option prices, the strike price calculation is as follows:

Strike 1. Buy an ITM CALL of 17700 at ₹350 (-)

Strike 2. Sell an ITM CALL of 17750 at ₹280 (+)

Strike 3. Sell an OTM CALL of 17850 at ₹100 (+)

Strike 4. Buy an OTM CALL of 17900 at ₹60 (-)

The positive and negative signs denote inflows and outflows of premiums.

Calculation of net premium received and paid

Total Premium Paid = ₹(350 + 60) = ₹410

Total Premium Received = ₹(280 + 100) = ₹380

Net Premium Paid/Received = ₹(410 – 380) = ₹30

Risk of this strategy will be covered by net premium paid of ₹30, respective to the lot size.

Maximum Loss = Net Premium Paid*Lot size

= ₹(30*50)

= ₹1500 is the limited loss.

Profit Potential

Long Call Condor will generate maximum profit if the underlying asset trades between the strike prices of the two sold call options. An ideal situation here is if Nifty50 trades between 17750 and 17850. In this scenario, the sold strike price of 17750 and 17850 call options will erode their value and add to the profit while approaching near expiration.

On the contrary, if the market breaks the range of two sold call options, the strategy will face loss but will be limited to the premium paid in buying call options.

Payoff

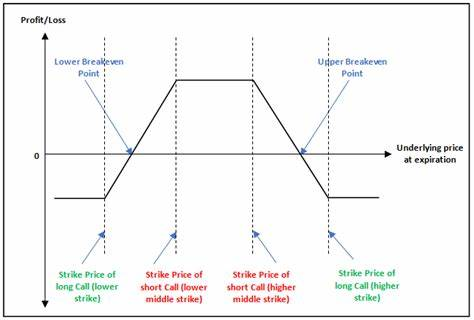

The diagram above shows payoff structure of Long Call Condor, vertical axis showing the amount of profit/loss and a horizontal axis showing price change in underlying till expiration. Let’s analyse the payoff diagram in relation to the strike price selected for this strategy.

Assuming Nifty50 at 17800

Strategy: Long Call Condor

Strike Price for this trade

- Buy option at 17700 (ITM)

- Sell option at 17750 (ITM)

- Sell option at 17850 (OTM)

- Buy option at 17900 (OTM)

The strategy will become profitable if the market closes between 17750 and 17850. In case of an upward move, Long Call Condor will generate a limited loss after breaking 17900 levels. While in the downside, loss will become limited after breaching 17700 levels.

Risk Reward

- Long Call Condor has a limited profit and risk payoff structure.

- This strategy remains profitable when the market is not volatile, with a low-frequency price movement in the underlying asset.

- The maximum reward is limited to two sold call options and becomes unprofitable if price moves beyond the two bought call options.

- The maximum loss is limited; it is advisable not to trade this strategy during any events or corporate announcements.

- To increase the profit probability of this strategy, a trader must choose a sufficient distance strike between two sold call options.

Break Even Point

Assuming the Nifty50 is underlying and trading at 17800 and Nifty50 has a Lot size of 50 shares, the break-even of Long Call Condor has been calculated below:

Lower Break Even Point = (Bought ITM Call + Net Premium Paid)

= ₹(17700 + 30)

= ₹17730

Upper Break Even Point = (Bought OTM Call – Net Premium Paid)

= ₹(17900 – 30)

= ₹17870

Maximum Loss = (Net Premium Paid* Lot Size)

= ₹(30*50)

= ₹1500

Maximum Profit = (Sold OTM Call – Sold ITM Call – Net Premium Paid)* Lot size

= ₹(17850 – 17750 – 30)*50

= ₹3500

Analysis of Long Call Condor Options Strategy

Theta is positive in this strategy, which tells this strategy will benefit from time decay as options contracts come to expiry; it will be the highest in between two sold call options in this strategy.

Delta is neutral in this strategy, which tells profit or loss incurred daily concerning movement in the Nifty50 in this strategy. It doesn’t increase or decrease much even if it moves outside the middle strikes of sold call options.

Gamma is negative, which shows the amount of loss the strategy will face daily if Nifty50 moves below the break-even point. Gamma will increase in this case.

Vega is negative; it projects how much this strategy will face loss due to a sudden spike in volatility. It will be the lowest when Nifty50 will trade between the two sold call options.

Final Word

A long call condor is a range-bound strategy where a trader expects that the market will not move significantly in either direction. This strategy is exclusively built to take advantage of low implied volatility. It is not compulsory to hold strike prices equidistant; a trader can alter strike prices depending on market bias.

Maximum profit is expected when price consolidates between two sold call options. Loss occurs when price breaches the lower or upper barrier of call options bought. This strategy demands a high margin as it involves selling two call options. Payoff is similar to the short Iron condor.

Frequently Asked Questions

In what market scenario can the Long Call Condor strategy be applied?

An ideal market situation for the success of this strategy is low volatility and sideways movement in the underlying prices. This strategy will profit from the time decay of sold options. Any non-event day will be suitable to open this strategy.

What are the advantages of Long Call Condor strategy?

The strategy profits when markets are not trending upward or downward. The profit is limited, as well as the losses. Long call condor provides a wider range of profit, reducing the chances of risk.

What are the disadvantages of Long Call Condor?

The premium paid and margin required to place orders are high, as four options strikes are traded. The profit is less compared to other strategies.