InCred Financial Services NCD: Review and Should you invest?

InCred Financial Service Limited (InCred) is coming up with its public NCD issuance, and they have filed a draft prospectus with SEBI. Let’s understand the profile of Incred, its business model, and its competitive analysis.

About InCred Financial Services

InCred is a non-deposit-taking systemically important NBFC registered with the RBI. The Company caters to lower middle-class to middle-class Indian households for their personal finance needs like education loans and personal loans.

Correspondingly, it also offers secured and unsecured business loans to small businesses, secured loans to K12 Indian schools for their expansion plans, supply chain financing, lending to profitable financial Institutions and microfinance companies and escrow-backed lending through its SME vertical.

History of InCred Financial Services

The company was incorporated in January 1991 as Visu Leasing and Finance Pvt Ltd. This company was acquired by InCred in 2016 and adopted the brand name InCred.

Subsequently, the company’s board approved the merger of Incred Financial Services Limited with the KKR Group at their meeting on September 3, 2021. NCLT then approved the merger on 6th May 2022.

Under this merger scheme, InCred Demerged Undertaking comprising the business of retail lending, SME lending, housing finance business and ancillary activities of Pre-demerger InCred was demerged and transferred and vested in the KKR India Financial Services Limited. Post implementation of the Scheme, the name of the Company was changed from KKR India Financial Services Limited to InCred Financial Services Limited.

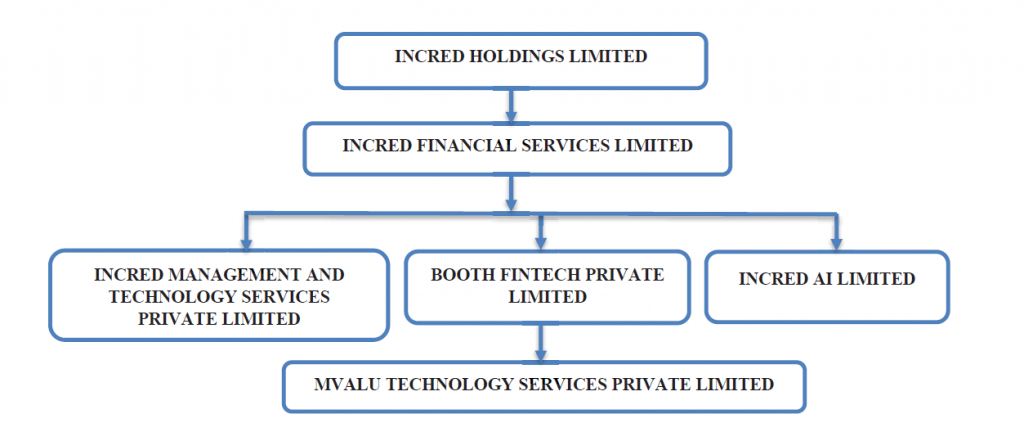

Group Companies and current Corporate Structure: –

Holding Company: – Incred Holdings Limited is an investment vehicle which holds a 100% stake in InCred Financial Services Limited.

100% owned Subsidiary Companies: –

- InCred Management and Technology Services Private Limited (IMTSPL) provides a new-age financial services platform that leverages technology and data science to make lending quick and easy.

- Booth Fintech Private Limited provides financial advice and assists in all financial, costing, accounting internal control and other similar matters. Booth Fintech holds 76% shareholding in mValu Technology Services Private Limited. mValu provides Software designing, development, customisation, implementation, maintenance, testing and benchmarking, designing, developing and dealing in computer software and solutions.

- InCred.AI Limited provides to offer training, consultancy, advisory and all related services in all areas of information technology.

Also Read: The Structure of Financial Markets in India

About the Promoter:

Bhupinder Singh, Whole-time Director & Chief Executive Officer is the Founder of the InCred Group. Prior to the InCred, he co-headed the Investment Banking and Securities division of Deutsche Bank for the Asia Pacific region with a USD 3 billion top line. In this role, he managed the Bank’s Fixed Income, Equities and Investment Banking divisions.

He was also the head of the Corporate Finance division for Deutsche Bank in the Asia Pacific region managing the bank’s corporate coverage, investment banking, capital markets, advisory and treasury solutions businesses. His experience spanned over two decades in the financial services sector, with more than 7 years in running and supervising Indian businesses. He holds a Post Graduate Diploma in Management (PGDM) from IIM Ahmedabad.

The Board and Management: –

The board and management of the company have seasoned professionals with relevant experience in the financial domain.

Currently, the board comprise of 8 directors, out of which one Director is a Whole-time Director and the Chief Executive Officer, one Director is Whole-time Director and Chief Financial Officer, three Directors are Non-Executive Directors and three Directors are Independent Directors, including one women director on the Board.

The Management is lead by Mr. Bhupinder Singh who is the CEO of the company and Mr Vivek Bansal, Incred’s Chief Financial Officer (CFO), has experience of two decades, which include leadership stints in Fidelity Investments (London) and Standard Chartered (Mumbai).

Business Model of InCred:

The Company offers secured and unsecured loans under various product segments such as consumer loans, education loans and MSME loans. Broad descriptions as under

Business Model of InCred:

The Company offers secured and unsecured loans under various product segments such as consumer loans, education loans and MSME loans. Broad descriptions as under

| Category | Product segment | Description | Product Specifics |

| Consumer Loans | Personal Loans | Short-term unsecured loans for different needs, including lifestyle purchases, with a focus on new to-credit & underserved credit customers.The company provides personal loans through our inhouse built Android application and through the website. | Loans upto ₹ 10 Lacs with tenure upto 84 months and an average yield of 24% |

| Education Loans | Student Loans | Loans for students pursuing higher education in India and abroad.These loans are primarily targeted at students pursuing post-graduate study and specifically at students pursuing a science, technology, engineering, mathematics (STEM) degree from the USA. | Loans upto ₹ 1 crores with tenure upto 180 months and an average yield of 12.6% |

| Secured School Financing and LAP | Loans to educational institutions for expansion/ upgradation of infrastructure and loan against property for personal or business needs | Loans upto ₹ 10 crores with tenure upto 180 months and an average yield of 14.6% | |

| MSME Loans | Anchor and escrowbacked business loans | Business Loans, Supply Chain Finance loans backed by Anchor Partners and escrow mechanism | Loans upto ₹ 10 crores with tenure upto 60 months and an average yield of 15.4% |

| Lending to FIs | Term loans to RBI Regulated MFIs and other NBFCs for onward lending purposes. | Loans upto ₹ 15 crores with tenure upto 36 months and an average yield of 13.7% |

AUM Classification as of 30th September 2022: –

| Category | Product segment | AUM | % Mix | Yield |

| Consumer Loans | Personal Loans | 1,923.62 | 38.08% | 24.30% |

| Education Loans | Student Loans | 809.93 | 16.03% | 13.00% |

| Secured School Financing and LAP | 528.24 | 10.46% | 14.70% | |

| MSME Loans | Anchor and escrow backed business loans | 969.84 | 19.20% | 15.50% |

| Structured Lending* | 301.18 | 5.96% | 11.70% | |

| Lending to FIs | 519.37 | 10.28% | 13.90% | |

| Total | 5,052.17 | 100.00% | 17.80% |

*Structured lending book includes the erstwhile KKR Wholesale lending book. This book is spread across 5 group accounts and is expected to run down in the near to medium term.

Company’s Financials:

Standalone

| Attributes | H1 FY23 | FY22 | FY21 | FY20 |

| AUM (₹ in Cr) | 5,052.17 | 3,843.76 | 2,644.65 | 2,095.37 |

| GNPA | 2.40% | 2.80% | 3.90% | 3.20% |

| NNPA | 1.10% | 1.40% | 1.90% | 1.50% |

| Net Worth (₹ in Cr) | 2,406.26 | 1,112.31 | 1,045.85 | 1,024.28 |

| Debt/Equity | 1.51 | 2.53 | 1.60 | 1.10 |

| PAT (₹ in Cr) | 64.69 | 36.12 | 10.23 | 2.75 |

| CRAR | 31.90% | 27.40% | 36.50% | 46.30% |

| Tier I | 0.90% | 0.60% | 0.70% | 0.60% |

| Tier II | 32.80% | 28.00% | 37.20% | 46.90% |

Consolidated

| Attributes | H1 FY23 | FY22 | FY21 | FY20 |

| AUM (₹ in Cr) | 5,052.17 | 3,843.76 | 2,644.65 | 2,101.88 |

| GNPA | 2.40% | 2.80% | 3.90% | 3.20% |

| NNPA | 1.10% | 1.40% | 1.90% | 1.50% |

| Net Worth (₹ in Cr) | 2,391.19 | 1,115.19 | 1,054.01 | 1,040.50 |

| Debt/Equity | 1.52 | 2.53 | 1.58 | 1.08 |

| PAT (₹ in Cr) | 46.76 | 30.83 | 2.17 | 5.16 |

| CRAR | 31.90% | 27.40% | 36.50% | 46.30% |

| Tier I | 0.90% | 0.60% | 0.70% | 0.60% |

| Tier II | 32.80% | 28.00% | 37.20% | 46.90% |

Key Observations in the financials:-

- The Net Worth of the company has doubled as of 30th September 2022 as compared to the net worth of ₹ 1,112 crores as of 31st March 2022 owing to the merger with KKR group. This equity increase will help the company to scale its portfolio in newer geographies.

- Company, on a standalone basis, has Deferred tax assets of ₹ 533.99 crores and Goodwill of ₹ 207.54 crores as of 30th September 2022. By reducing these intangible assets and others from the net worth, the tangible net worth (TNW) stood at ₹ 1659.54 crores and consequently, the Debt/TNW stood at 2.19x as against the D/E of 1.51x as of 30th September 2022.

- After the amalgamation, erstwhile KKR India’s wholesale lending book has also become a part of the overall AUM of Incred. However, this book forms 6% of the AUM and is expected to run down fully over the next 2-3 quarters.

- As can be seen from the GNPA numbers in the above table, the portfolio quality of the company is on an improving trend.

Peer Comparison: As of 31st March 2022

| Attributes | InCred | Ugro Capital* | Profectus Capital* |

| AUM (₹ in Cr) | 3,843.76 | 2,969.00 | 1,529.61 |

| GNPA | 2.80% | 2.30% | 0.78% |

| NNPA | 1.40% | 1.70% | 0.65% |

| Net Worth (₹ in Cr) | 1,112.31 | 966.53 | 767.22 |

| Debt/Equity | 2.53 | 1.86 | 1.15 |

| PAT (₹ in Cr) | 36.11 | 14.55 | 8.11 |

| Net Profit Margin | 16.26% | 4.64% | 5.02% |

| CRAR | 27.40% | 34.55% | 48.23% |

* Ugro and Profectus are in MSME financing, and their products include secured and unsecured term loans, Machinery Finance, Supply Chain Finance etc. Incred has two products, Consumer Finance and Education Loans, which Ugro or Profectus do not offer. Since InCred is into diversified business, a direct comparable entity is unavailable.

| Credit Rating | InCred | Ugro Capital | Profectus Capital |

| CRISIL | A+ (Stable) | A- (Stable) | A- (Stable) |

| CARE | A+ (Stable) | Not Rated | A- (Stable) |

| ICRA | Not Rated | Not Rated | Not Rated |

Credit Rating History:

| Calender Year | 2018 | 2019 | 2020 | 2021 | 2022 |

| Rating | A (Stable) | A (Stable) | A (Negative) | A (Watch Positive) | A+ (Stable) |

Note: In 2020, the company’s rating outlook was downgraded to A (Negative) from A (Stable) due to ongoing uncertainty prevailing during COVID-19. The company has been able to recover that phase and the Net worth and the portfolio quality, both have been significantly improved post COVID.

Borrowings of the Company:

As of 30th September 2022, company has total o/s debt of ₹ 3642.15 Crore, as follows:

| Nature of Borrowings | O/s Amount | % Share |

| Secured Borrowings | 3,453.78 | 94.83% |

| Unsecured Borrowings | 188.38 | 5.17% |

| Total | 3,642.15 | 100.00% |

| Borrowing Type | Total | % |

| Term Loan from Banks | 1,683.17 | 46.21% |

| Term Loans from Others (include NBFCs, other FIs etc) | 294.06 | 8.07% |

| External commercial borrowings | 57.18 | 1.57% |

| Inter corporate borrowings from other parties | 25.00 | 0.69% |

| Loans repayable on demand (WCDL and CC) from Banks | 229.87 | 6.31% |

| Debentures | 1,189.49 | 32.66% |

| commercial Papers | 163.38 | 4.49% |

| Total | 3,642.15 | 100.00% |

The company has 28 banks, NBFCs as lenders on its balance sheet; however, large private sector banks – ICICI and Kotak are missing. HDFC took debt exposure in June 2022 in the company.

Top 5 lenders: Top 5 lenders forms ~33% of total borrowings.

| Lender (₹ in Cr) | O/s Amount | % Of Total Debt |

| SBI | 518.01 | 14.22% |

| Bank Of Baroda | 255.83 | 7.02% |

| Union Bank of India | 161.04 | 4.42% |

| Bank Of Maharashtra | 135.26 | 3.71% |

| IDFC Bank | 131.95 | 3.62% |

Comforts/Concerns on the Entity:

Comforts:

- Experienced Promoter and Management.

- Diversified Portfolio with heterogenous product offerings. This will help the company avoid concentration risk and maintain portfolio quality.

- Comfortable Capitalised with low D/E of 1.51x as of 30th September 2022, and debt to TNW stood at 2.19x as of the same date.

- Comfortable portfolio quality – Gross NPA stood at 2.40% and Net NPA at 1.10%. Credit cost for H1 FY23 was negative 0.4% due to the reversal of the provisions and 1.35% for FY 2022 as a % of average AUM.

Concerns:

- Restructured book of the company stood at ₹ 107.50 crores as of 30th September, 2022 and out of which ₹ 11.4 crores is NPA. Though this book comprises 2.1% of the overall AUM, the recoverability in this portfolio will be key monitorable.

- As the company started its operation in February 2017, some long-tenure products like Education loans, Secured School Financing, and LAP have yet to achieve seasonality. The future portfolio quality is to be monitored in this portfolio. The Current GNPA in the MSME book stood at 5.68% as of 30th September 2022.

- Real estate exposure – the company has wholesale lending exposure of ~300 Crore (6% of AUM) as of 30th September 2022. This book belongs to KKR India’s wholesale lending book, and these loans are spread across 5 borrower groups (average outstanding of ~ ₹ 60 crores per borrower). Defaults in these accounts might affect the portfolio quality of the company.

Source of data: Draft Prospectus, Annual Report, Rating Rationale, Quarterly results, etc.