IMPS vs NEFT vs RTGS – Know the difference

India has four funds transfer systems in place to ensure that financial transactions can be conducted efficiently and securely. These systems are the Real Time Gross Settlement (RTGS), the National Electronic Funds Transfer (NEFT), the Immediate Payment Service (IMPS), and the Unified Payments Interface (UPI).

Each of these has its own unique place in India’s payments ecosystem

1. RTGS – Real-time gross settlement

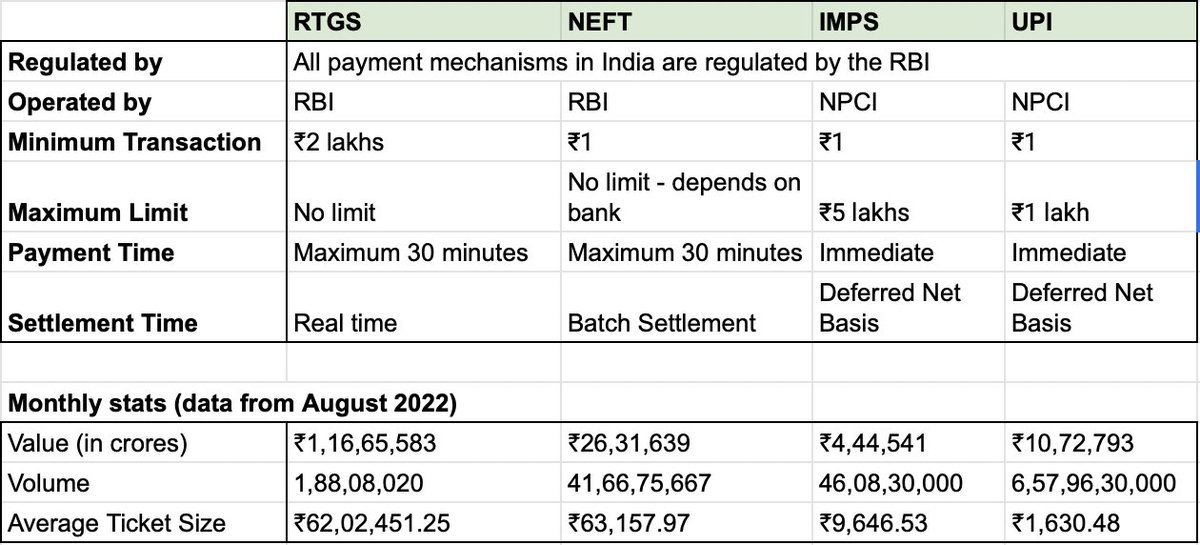

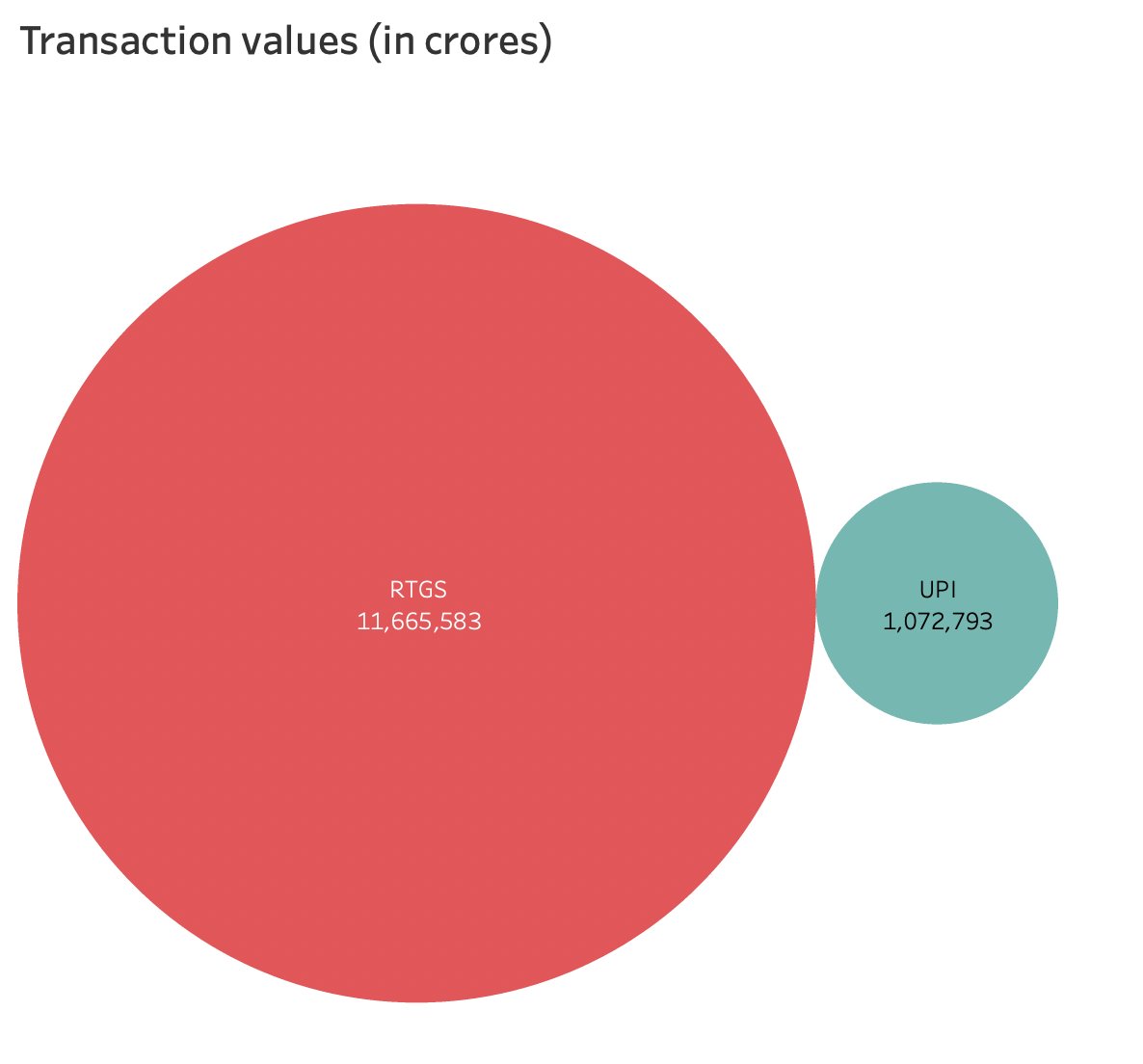

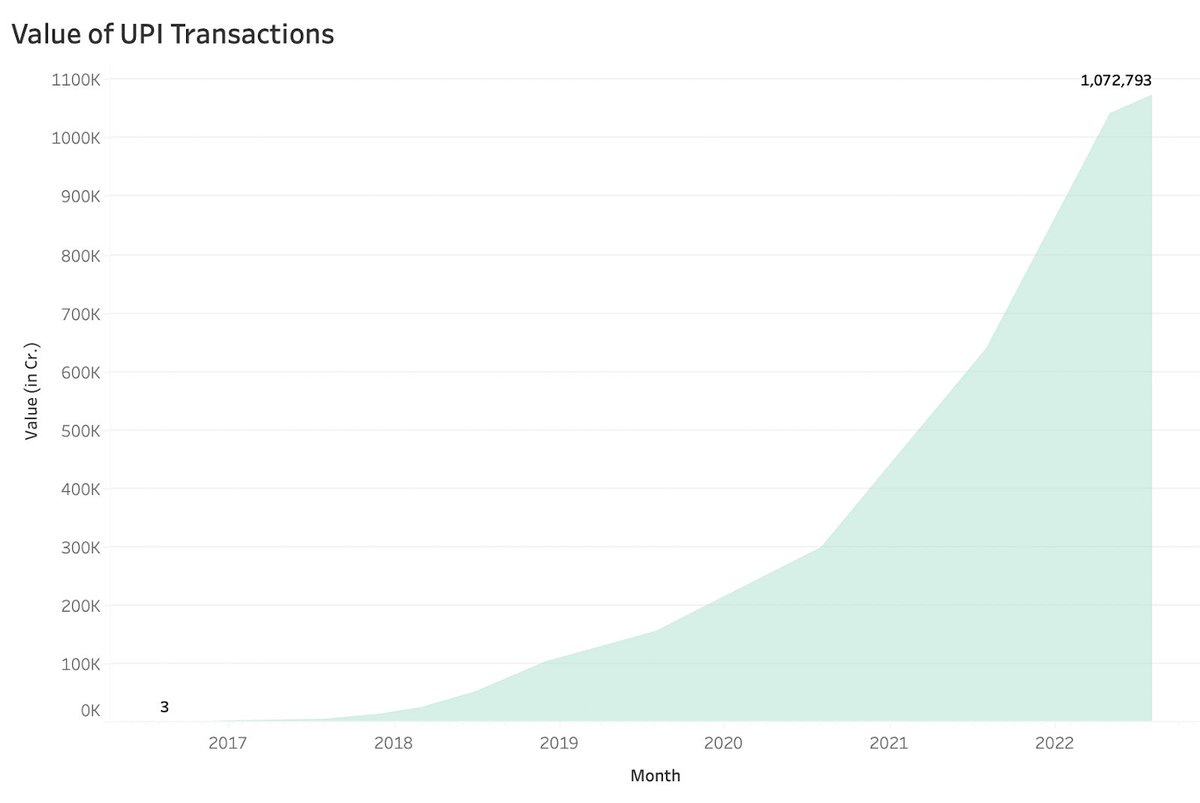

While UPI has had a huge spike in adoption and volumes, to this day the heavy hitter remains RTGS.

Of course, UPI is more retail focussed with a cap on maximum transaction value, while institutions mainly use RTGS which has no upper limit for transactions. However, just for comparison’s sake, this is the monthly transaction value through RTGS and UPI.

Before RTGS was introduced in 2004, banks used to individually transfer funds to each other. But this led to a huge systemic risk – if even 1 bank failed to pay, the domino effect would affect all banks.

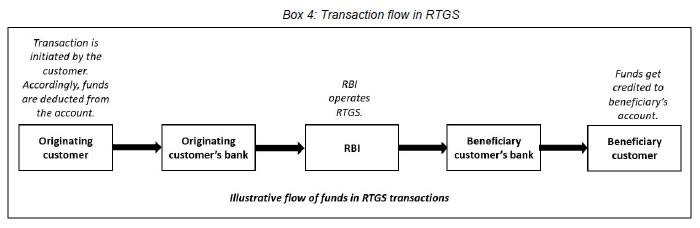

To counter this, the RBI set up RTGS which is operated by the RBI itself. Each transaction gets processed and settled individually on a real time basis.

All these transactions happen on the books of the RBI which makes them irrevocable and legally valid.

The other system which is used is Deferred Net Settlement where all transactions are settled at the end of the day. But this would increase settlement risk where the bank would not have funds to settle transactions at the end of the day.

While initially, it was only for settling inter-bank transactions, later it was extended to regular customers as well. This is the RBI’s circular in 2004 which officially launched RTGS for bank customers.

The minimum transaction is 2 lakhs. And it is primarily used by institutions, large merchants and businesses to transfer funds. The average transaction size was ~62 lakhs for August 2022..

Costs – It requires significant investment to maintain such an infrastructure for the RBI as well as banks. While the RBI doesn’t charge any fees to banks and banks can choose not to pass on these charges, many banks do charge fees for transactions.

Online transactions are free for many banks and RBI has kept a maximum cap on charges based on transaction size. For transactions of ₹2 lakh to ₹5 lakh, the cap is ₹25 and ₹50 for transactions above ₹5 lakh.

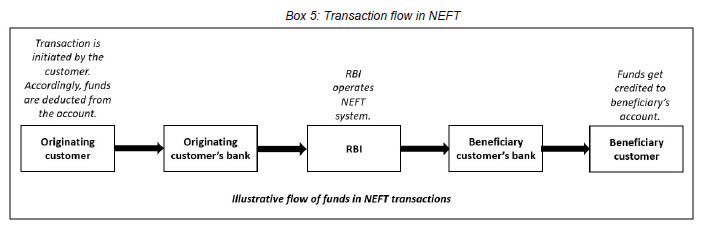

2. NEFT – National Electronic Fund Transfer

Digitisation meant formalisation of payments, lower printing & operating costs, greater ease and transparency. India’s payments ecosystem today has been built on the foundation of NEFT and RTGS.

NEFT started in November 2005 and it allowed retail bank customers to transfer funds between any two NEFT-enabled bank accounts. UPI and IMPS today are much faster ways to transfer funds but in 2005, NEFT was a game changer.

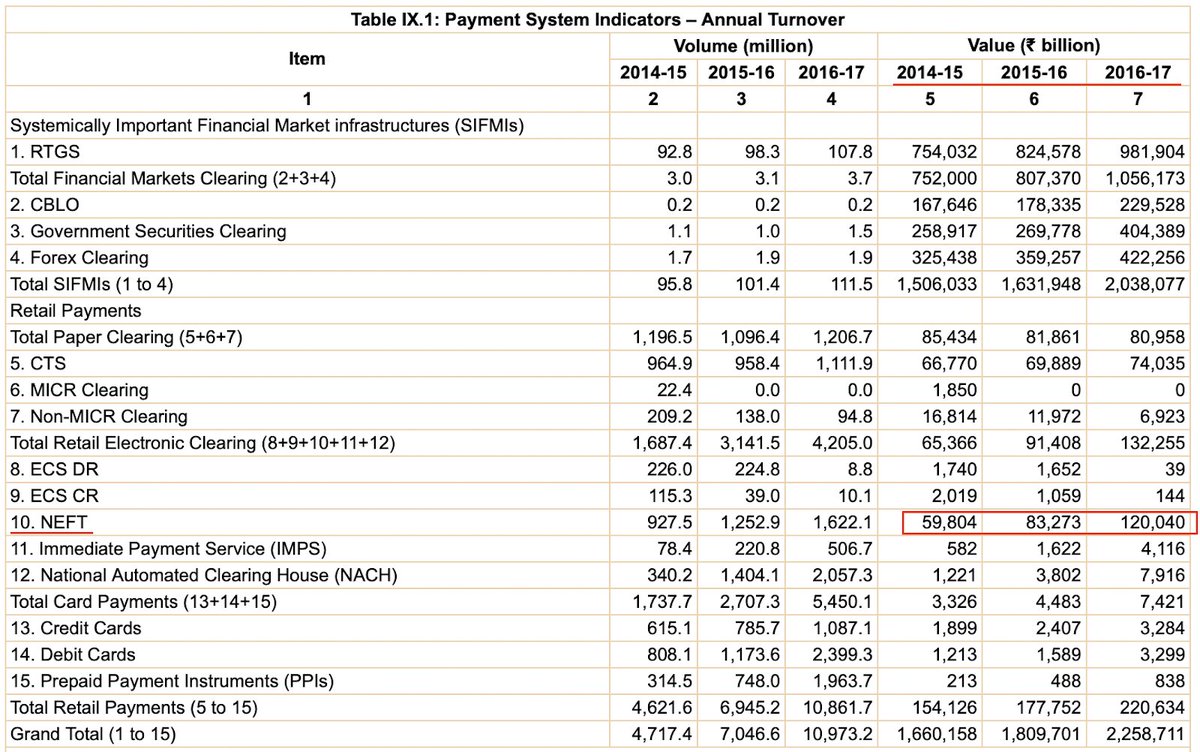

Even in 2017, it was growing by ~40% annually. The total value of transactions was more than ₹120 lakh crores.

Initially, NEFT transactions were settled in batches once a day. Based on the needs of customers, this was reduced to once every 2 hours and now once every 30 minutes. And there was no minimum transaction value. You can send amounts as low as ₹1!

Even though RBI operates the system, banks also incur costs to maintain the infrastructure, manpower and security. While RBI would be justified in recovering these costs, RBI has mainly operated it as a public good.

The RBI has also recommended banks not to levy charges for savings account customers. Most banks have kept online transactions free and there is a cap on charges for transactions undertaken through the branches.

A very interesting thing about NEFT is that you can make a payment even if you don’t have a bank account. You can make a cash transaction to another bank account.

The use cases for NEFT are many even apart from funds transfer, like paying credit card dues, loan EMIs, inward forex remittances, etc. Nowadays UPI can fulfil these needs but NEFT is a much older mechanism with a singular motive of driving digital adoption.

3. IMPS- Immediate Payment Service

Until 2010, the 2 ways to transfer funds online were RTGS and NEFT. These transactions could only happen within RTGS and NEFT working hours. To solve this problem, NPCI along with a few banks ran a pilot study to create a system that worked 24×7.

It officially launched in November 2010 to the general public.

You could transfer funds up to ₹2 lakhs, on a real-time basis. This was recently hiked to ₹5 lakhs.

Unlike RTGS, where settlement of each transaction happens in real time, the settlement between banks in IMPS is on a deferred net basis – the transactions are settled between banks at the end of the day where only a net amount has to be transferred.

As mentioned in RTGS, there are risks involved when settlement happens on a deferred net basis. When payments happen in real time but settlements on a deferred net basis, risk has to be mitigated.

For this, NPCI maintains settlement guarantee funds (which are funded by the participating banks and NPCI’s own funds), lines of credit, etc.

Since direct participants have to place their funds with NPCI, they incur a cost for participating in the IMPS system in the form of the cost of such funds. And the other major cost is operational costs.

The participating bank imposes charges on the originator in an IMPS transaction and the NPCI in turn imposes transaction fees on the participant banks to recover its cost of operations.

Interestingly, despite mechanisms which facilitate funds transfer without charges, IMPS has continued to grow over the years.

It also has a few advantages over UPI – while UPI transactions are mobile based, IMPS transactions can also be done from other devices. And IMPS also allows non-bank entities like PPI issuers to facilitate transfers from wallets to the beneficiary’s bank account.

4. UPI – Unified Payments Interface

UPI of course needs no introduction. Over the last few years, UPI has grown a lot! It has brought a lot of people into the financial system and has made digital payments as simple as taking a photo.

In 2016, the larger idea behind UPI was that by bringing Peer to peer payments for even small amounts online, the amount of cash in the system would go down, all transactions in the system would be tracked, tax evasion would go down and government revenues would go up.

Compared to IMPS, it was also safer since you didn’t need to share details like bank account number. And with the growing use of smartphones in India, it was expected that a large number of transactions would be carried out through phones.

Put very simply, UPI allows you to instantly transfer funds through your mobile 24×7.

But the beauty of UPI lies in its simplicity – the fact that you could send money from your bank account to another by simply entering someone’s phone number, UPI ID or scanning a QR code.

UPI as a funds transfer mechanism is great but it can also be used to pay merchants.

Compared to the T+n settlement cycle for card settlements, even merchant received their money in real-time.

And in 2020, the Government mandated a zero-charge framework for UPI. This means that UPI charges would be 0 for users and merchants alike.

Even back in 2016, people were bullish on UPI and considered it to be a game changer but no one realised to what extent.

Recently, the debate on whether UPI should be charged or not has been reignited. But the ministry of finance has clarified that UPI will be operated as a digital public good and there is no consideration to levy any charges for UPI services.

However, there is the question of whether the no MDR is sustainable for all participants. The government put aside ₹1300 crores to subsidise UPI and RuPay but the payments council of India has estimated the real cost for UPI alone to be closer to ₹5500-6000 crores.

A comparison of the 4 funds transfer systems