Economics of a pension scheme – Where does the money come from?

Augustus Caesar transformed the Roman Republic into an Empire through conquests and political reform. In these conquests he added territories (marked green) and gathered significant wealth in his conquests. But he worried that retired soldiers might rise up against the empire.

Augustus Caesar transformed the Roman Republic into an Empire through conquests and political reform. In these conquests he added territories (marked green) and gathered significant wealth in his conquests. But he worried that retired soldiers might rise up against the empire. pic.twitter.com/EsIMfdBjfk

— anshul gupta (@anshgupta64) September 25, 2022

So he came up with a solution: after 20 years of service in a legion and 5 years in the military reserves, all soldiers would earn a pension equal to 13x the annual salary. His reasoning was that if he paid the veterans, they would be less likely to overthrow him.

This was how the first pension scheme ended up getting created. These pensions were either lump sum payments, land grants or an appointment to some prestigious position.

These armed forces pensions were financed at first by regular taxes, then to increase the tax revenues, by a 5% inheritance tax. In 5 or 6 AD, Augustus established a special military fund just for these payments.

While the pension did ease tensions within the empire, it was one of the main reasons for the Roman empire’s eventual collapse in the later years. It fell into a decline and struggled to finance this pension.

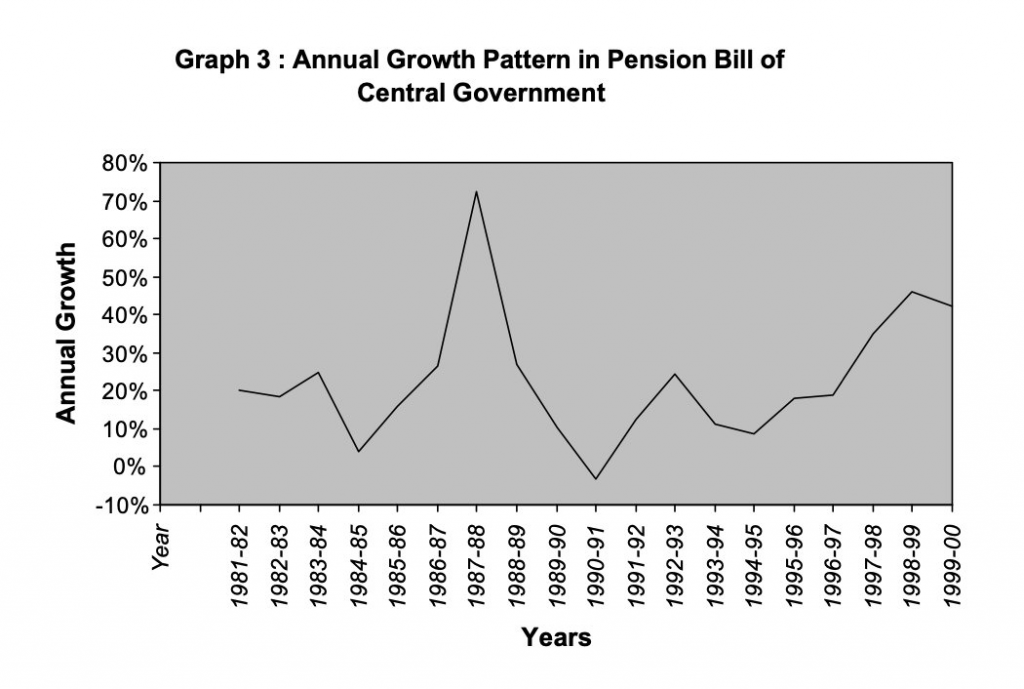

This is not a one-off example but a pattern throughout the ages. Many governments when they first introduce their pension schemes don’t realise how much more the schemes would cost in the future.

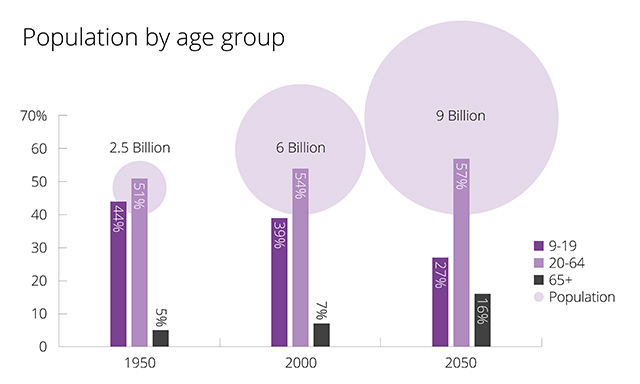

They try to work around this by setting the age at which you become eligible for a pension much higher than the life expectancy. But they end up underestimating population ageing, increase in life expectancy, etc.

E.g., when Germany introduced its old-age and disability pensions (which could be accessed upon turning 60), the average life expectancy of Germans was only 45. Today the life expectancy is 81, and pension payments make up 28% of government spending.

But how do governments fund these pensions?

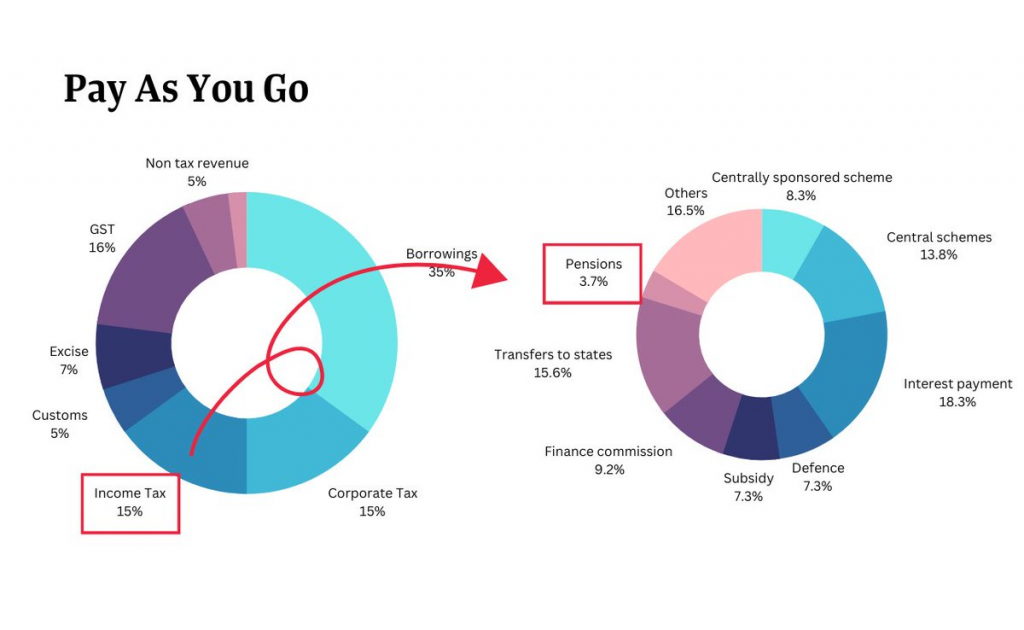

Most schemes in the 20th century ran “Pay-as-you-go” pension schemes. They were defined benefit pension schemes – where the pension amount (benefit) to the retiree is defined (fixed) and how to pay for them is the government’s problem.

In PAYG (pay as you go) systems, the governments use tax revenue from the working population to fund pensions for the retired population. There are no savings of any kind. However, there are stages that the country goes through which affect the success of these schemes.

Stage 1 – Majority of the population is young. For each pensioner, there are more than 15 contributors. The tax revenue that comes from the working age population is more than enough to pay for the pensions and as a result, the pension payouts are much higher than normal.

Stage 2 – Economy encounters the first challenges. The first of the working generation retires and the number of contributors to pensioners drops to ~ 8-14. The scope of the pension is widened – e.g. introducing it to lower income groups, while still keeping the benefits high.

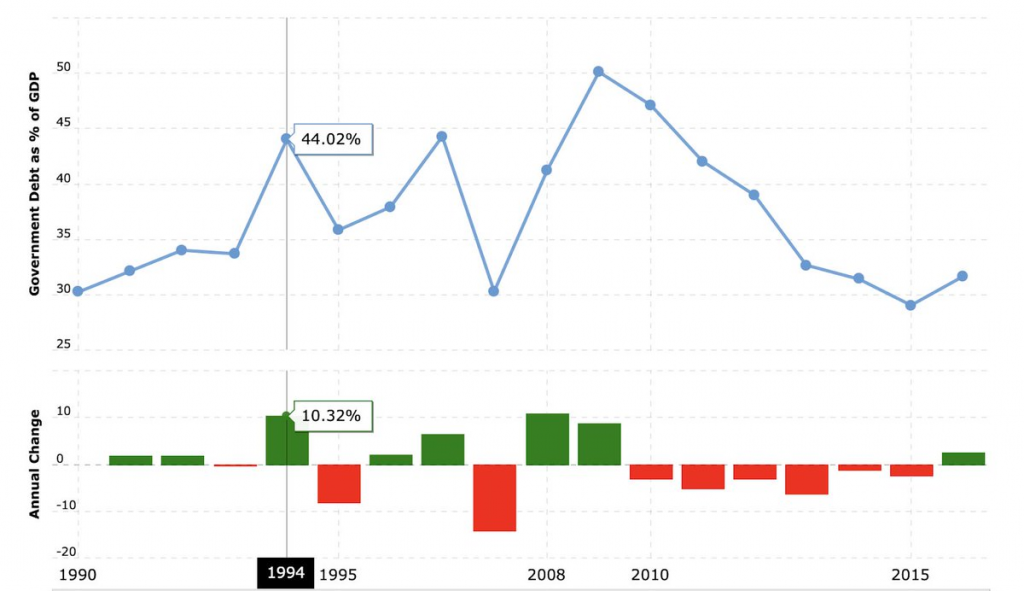

While the population loves the expansion, and expects great pension benefits in the future, the rising pension costs leads to deficits and governments accumulate debt, as high as 25% or 50% of GDP. Brazil and Turkey in the 1990s are examples of this stage.

Stage 3 – there are less than 6 contributors for every pensioner. Most of the population is covered but the debt starts threatening the sustainability of the scheme.

More contributions are needed from the working population to support the system, which is unhappy and wants to reduce contributions.

And the middle-aged and old population who have contributed for most of their lives, want to receive their pensions.

Due to this conflict, reform attempts get postponed, and countries reach into their budgets to help finance the pension expenditure, which now reaches double digits as % of GDP.

India has 5.83 crore tax filers (data as on August 2022) and 52 lakh pensioners. That means there are 11.2 contributors for every pensioner not counting people who are involved in agriculture but not filing taxes.

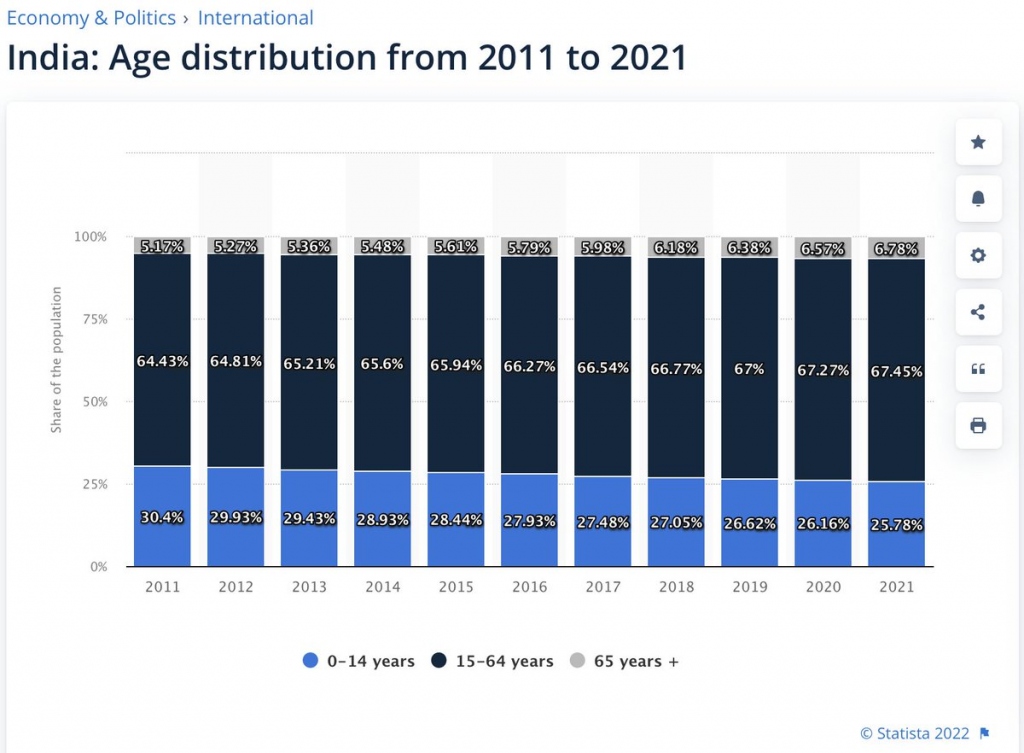

And this is while our population is still young. The elderly population is slowly and steadily rising.

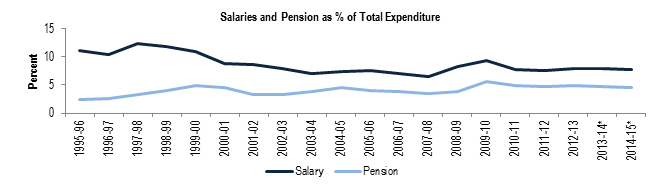

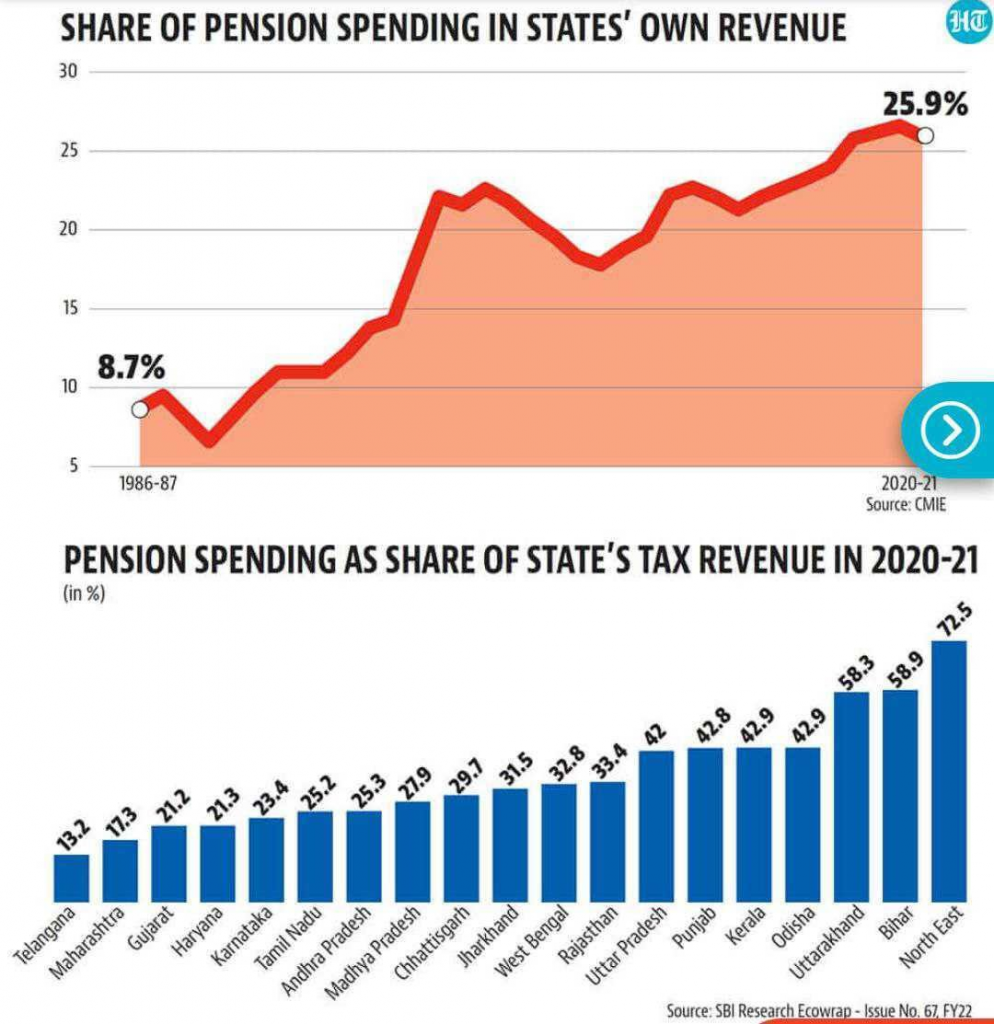

Until 2003, government employees received a pension equal to 50% of their last salary. Even when the share of central government employees in the organised sector gradually decreased over the past 15 years, pension spending as a % of the budget increased.

It became important to find an alternative to the pension scheme. In 1999 the Government of India commissioned a national project, OASIS (“Old Age Social and Income Security”), to examine policies related to old age income security in India.

Based on the recommendations of the OASIS report, the Government introduced a Defined Contribution Pension System – NPS for all new Government employees, except for the Defence forces. Despite strong protests we managed to switch to the National Pension Scheme in 2003.

What is a defined contribution scheme?

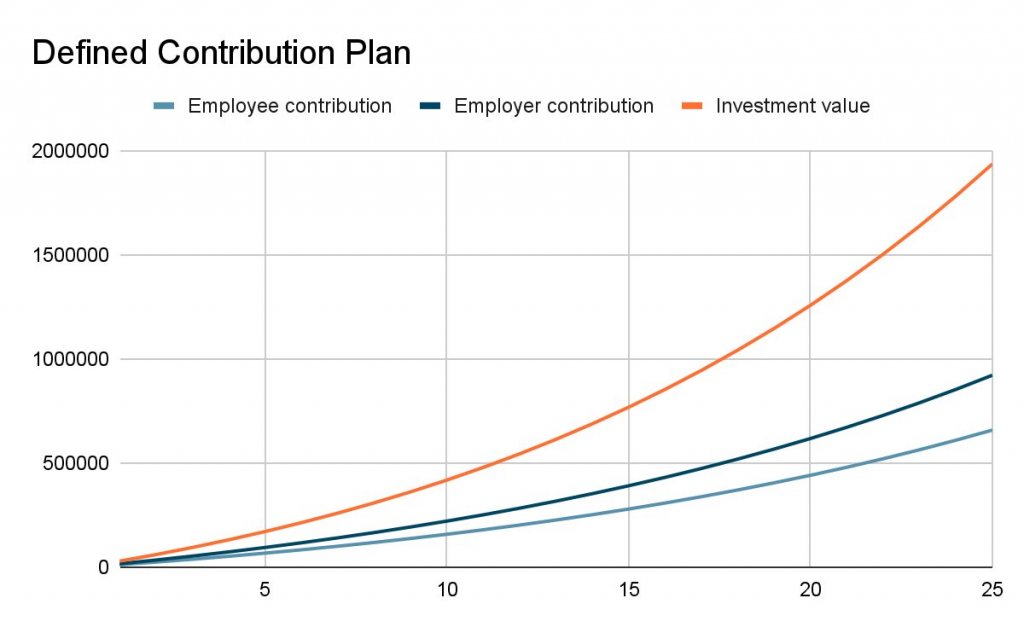

It is a retirement plan where the employer and employee both make contributions on a regular basis into an individual investment account. In the NPS, this is then invested in a portfolio of equity, corporate bonds and government bonds.

In the NPS, the government contributes 14% of salary and 10% of the government employee’s salary is mandatorily invested. The final amount accrues based on the returns that this portfolio earns.

While the employee takes more investment risk in the NPS compared to the old pension scheme, the success of the old scheme depended on the majority of the population contributing to taxes.

And while the NPS was initially designed for government employees only, it was opened up for all citizens of India in 2009. NPS is an attempt to create a pensioned society in India.

To make the NPS attractive, the government has attached tax benefits. Earlier it had EET status but it achieved EEE status in 2018, where the Government amended the NPS to allow the final corpus to escape tax at maturity.

EEE status means the amount invested, the gains and maturity amount all are exempt from tax. The drawback is the long lock-in period and the fact that you only receive 60% as a lump sum and you have to use 40% to purchase an annuity.

Is there no way to make defined benefit plans work?

Yes. Fully funded schemes work.

How do these schemes work?

The employer (usually a private company) maintains an investment fund to make pension and gratuity payments in the future.

The payment is calculated based on years of service, and salary towards the end of the career. And at the end, payment is made from the final corpus. The employer is responsible for the payments and assumes investment risk.

Why can’t the government do this?

Note how fully funded schemes require savings from the employer. In a growing economy, the opportunity cost of this savings would be too high.

It would make more sense to spend on infrastructure and development projects which can also create employment. The main difference between a defined contribution and a defined benefit plan is long-term sustainability.

A defined contribution plan means everyone is responsible for their own retirement. When the population ages or life expectancy rises, the cost of defined benefit plans shoot up and governments have to either raise taxes or borrow.

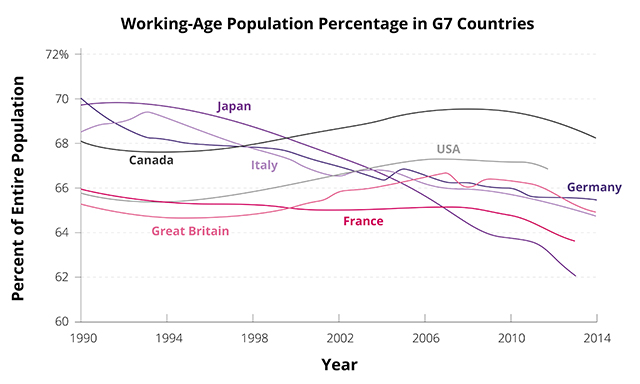

Globally as well, the % of the population that is older than 65 is growing. This happens when people have fewer children and life expectancy goes up. In the next century, the same will happen to the Indian population.

Is the NPS a good replacement for the Old Pension Scheme?

@deepakshenoy has run the numbers. With reasonable assumptions, it is possible for the NPS to create a higher corpus at the end.

So many questions asking how will NPS be able to pay half salary at end of 35 years?

— Deepak Shenoy (@deepakshenoy) September 21, 2022

Considering past returns of 9.65% p.a. and with some simple assumptions, a calc shows NPS should create a corpus that is 20% higher than required to generate half of terminal salary as pension. pic.twitter.com/GwhLb2MXcf

Compared to the safety of having a fixed pension, investing personal savings into the NPS and taking market risk is psychologically less appealing. This has led to a disturbing trend where states are moving back to old pension schemes even if they can’t afford it.

If a large part of the budget which could go to development projects goes to just make pension payments and interest payments (due to increased borrowing needs) to a small % of population, the Indian growth story would lose steam.

SIde fact – Everyone who contributes to EPF is eligible for a pension of up to ₹7.5k under Employee Pension Scheme. Out of employer contribution, a small portion goes towards this EPS which you can claim on retirement by getting an EPS certificate made.

In the coming century, most of the countries will have a much older population than they are used to supporting. That makes it more crucial to have a pension system that works for a long time than a system which works well for a few years.