What Happens to Secured Bond Holders if the Company Goes Bankrupt?

Did the word ‘bankruptcy’ just ignite fear in you?

Well, you’re not the only one!

Whenever we hear the words ‘bankruptcy’ or ‘default’ buzzing around, we almost automatically feel that our investment principal is lost.

Now here is where we beg to differ. There are different circumstances in which a company can go bankrupt.

In this article, we will explain what happens to secured bond holders who have invested their money in NBFCs and then, the NBFC defaults.

The question you must be asking now is, “Will I get my money back?”.

Let’s find out.

What Happens When a Company Defaults?

Before November 2019, financial service providers like NBFCs were exempt from insolvency* proceedings. This was under the Insolvency And Bankruptcy Code, 2016.

However, on 15th November 2019, the Government introduced rules called the Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019.

What happens when this rule comes into force?

Through this rule, the government empowers RBI or Reserve Bank of India to refer NBFCs and HFCs (housing finance companies). Basically, institutions that are about to default, with assets worth at least Rs. 500 crore to insolvency courts, as per Section 227 of the Insolvency and Bankruptcy Code.

*(a situation where a borrower can no longer pay its dues to the lenders)

How Is the Insolvency Proceeding Initiated?

The process is divided into 4 simple steps. Let’s go over them one by one.

Step 1

Only RBI can initiate the bankruptcy proceedings against an NBFC. (Yes, RBI is pretty powerful!)

Step 2

RBI will first file an application to initiate the bankruptcy proceedings to NCLT (National Company Law Tribunal).

Step 3

There will be an interim moratorium (when an activity is temporarily stopped) on the NBFC, from the date of filing the application, till the date of admission or rejection of the application.

Once the application is admitted by NCLT, the insolvency proceedings start and a 6 months moratorium is ordered. During this time, the committee of creditors have to come up with a resolution plan to revive the company.

Step 4

On admission of application for initiation of the insolvency proceedings, RBI will also appoint an administrator who will look after the bankruptcy proceedings for the company. The administrator will take over the management of the company during its insolvency proceedings.

Think of it this way, Mr. A has a house of his own. Now let’s imagine Mr. A suffers an untimely demise, what happens next?

In this situation, a caretaker is appointed for the house, who manages all the proceedings related to the house. The above situation is similar.

What are the Stages of Insolvency Proceedings?

Let’s say Company ‘X’ has defaulted.

What happens to it now?

Well, there are two types of proceedings under IBC (Insolvency and Bankruptcy Code):

- Insolvency proceedings;

- Liquidation proceedings.

Let us give you some context before we go into the details.

In the first step, the entity will be tried and revived. If reviving the entity does not succeed, then step 2 will be implemented, which is, liquidating the entity.

1. Preparation of Resolution Plan under Insolvency Proceedings

At the outset, the committee of the creditor, with the consultation of the administrator will come up with a resolution plan.

The committee of creditors (basically, lenders in the case of an NBFC), are tasked to come up with a resolution plan where they try to revive the company through certain means. These means can be extending the tenure of loans, reducing the interest rate or reducing the principal outstanding itself.

The NBFC can also be acquired or merged with other NBFCs, so the company can stay afloat (Eg: In case of DHFL’s insolvency proceedings, Piramal Capital acquired the company, as per the resolution plan).

The committee of creditors may approve a resolution plan if 66% of financial creditors agree. Here, the voting share will be decided by the outstanding amount of each financial creditor.

What is the position of secured bond holders under insolvency proceedings?

Since secured creditors are part of the committee of creditors, they have the right to vote to approve or reject the resolution plan. In addition to this, the priority to receive any proceeds will be given to secured creditors.

2. Liquidation Proceedings

If the committee of creditors do not reach a consensus and are not able to approve the resolution plan or decide whether the company should be liquidated or not, then NCLT may order the company to be liquidated.

What is the position of secured bond holders during liquidation proceedings?

As a secured bondholder, this is probably the most pertinent question you might be asking.

Here, secured creditors have 2 options in the liquidation proceedings:

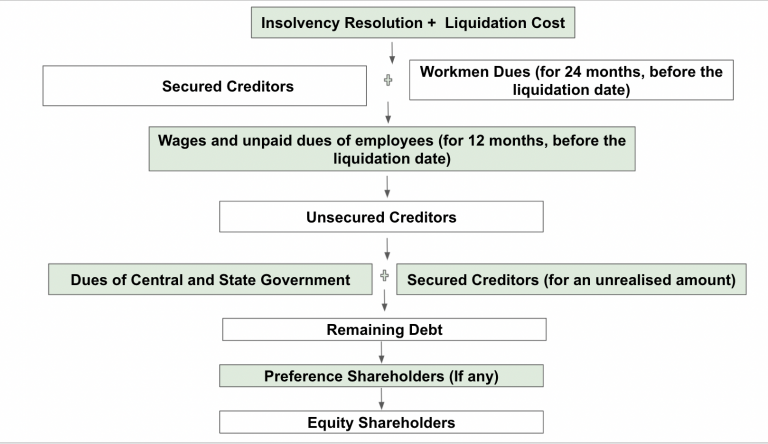

- The first option is that the bondholder can relinquish (give away) its right in the security and hand it over to the liquidator. The liquidator will then realise the proceeds from the security and the money will be received by secured creditors as per the waterfall mechanism (Provided in section 53 of the code – also illustrated below);

- The second option is that bond holders can sell the cover pool or security and realise their money, which will help them recover their dues.

Distribution of Assets as per Section 53

This is the last stage of the liquidation proceedings. Here, the liquidator will realise the asset and the proceeds recovered from, will be distributed as the picture shown below:

As can be seen in the above flowchart, the secured creditors stand first in line during liquidation proceedings.

Wrapping Up

We hope the above article has given you enough context about the liquidation process of secured bonds. If you want to know more about secured bonds, its liquidation process and the debt market in general, please feel free to reach out to us on hello@wintwealth.com.

You can also send us a message on our WhatsApp number. Our team will be happy to happy to assist you.

Till then, Happy Winting!