Piercing Line Candlestick Pattern: Meaning, Formation and Advantages

Technical analysis is a trading discipline used to evaluate investments and identify short term or long term trading opportunities by analyzing charts of price movement and volume with the help of certain indicators.

There are several types of technical tools and indicators which will go a long way in simplifying your stock trading experience. There are a number of patterns with which traders try to identify how the share price might potentially move. Piercing line candlestick pattern is one such indicator which provides important market signals to traders. It acts as a bullish reversal indicator over the short term if formed after a downward trend

In this article, we will see different aspects related to this trading pattern, like its formation and various trading strategies.

What is a Piercing Line Candlestick Pattern?

This is a bullish indicator candlestick which implies that the market or a particular stock will move upwards. This pattern gets formed after an extended bearish run in the markets. Several analysts see the formation of this pattern as a re-emergence of bullish market sentiments.

During the formation of this pattern, initially, there is certain indecisiveness at support levels. Later, the situation reverses, and the bulls or the buyers gain control and push bears out of the scene.

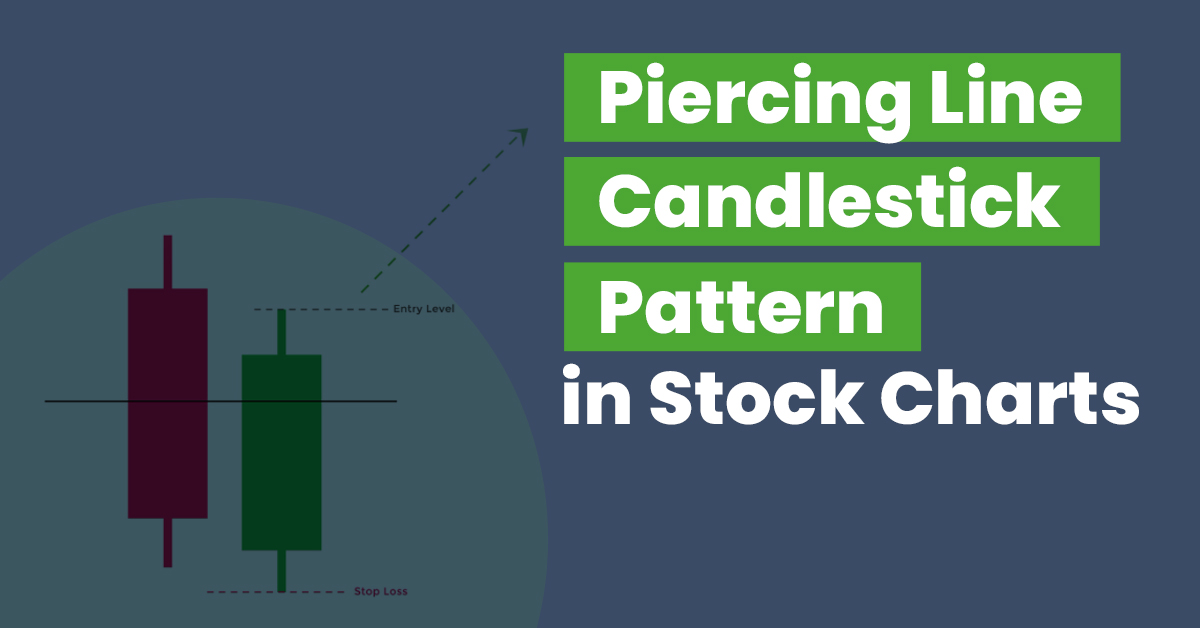

This candlestick pattern contains two candles. The second candle opens at a lower price than the closing of the first one. However, the second candle quickly reverses to close at a higher level, and in the process, it pierces the top portion of the first candle by closing slightly below the top of the first candle. That’s the reason it’s named as a piercing candlestick pattern.

Many traders also see this pattern as support levels implied by the price bouncing off the base of the second candle’s body. Suppose it has two consecutive green candles with a red candlestick in between them forming (+) type of candle. In that case, it is also known as the doji star candlestick pattern, which acts as a reversal signal, just like a hammer and inverted hammer candlesticks.

Now that you know what a piercing line candlestick pattern means let’s focus on its other aspects like formation and working.

How Are Piercing Line Candlesticks Formed?

The formation timeline of this pattern is two days. The first candle in this pattern is influenced or dominated by sellers, whereas buyers dominate the second candle. It is representative of a reversal in market sentiments for a short-term advancing trend.

The preceding candle of this pattern indicates a downward trend in the asset’s price. Under this pattern, you can see that the supply of shares meant for selling has reached its upper ceiling. This, in turn, leads to buyers coming into the market, and they begin to push up the stock prices.

The second candle of this pattern starts with a small gap. Gaps can only be formed if a security’s opening price is higher or lower on the second day compared to the previous day’s closing price . In the bullish piercing line candlestick, the second candle opens with a gap implying that the opening value is lower than the closing value of the previous day.

Moreover, the second candle closes at a value nearer to the opening price of the first day. In order to have a clear piercing line pattern, the second green candle shall cover at least half of the last day’s red candlestick.

How Does the Piercing Line Candlestick Pattern Work?

This pattern offers confirmation signals of reversals whenever the stock price has been pierced from below the opening price and closed at a higher level than its opening price. As a part of your trading strategy, you can use this pattern over variable time periods. You can analyse this pattern in a 5-minute or daily and weekly charts.

These patterns are not common and are rarely formed. . Therefore, you should not be over-reliant on this pattern and look for confirmatory signals from other technical or chart-based tools.

Suppose a bullish piercing line pattern forms in an uptrend-sloping moving averages; you can take an appropriate position. As these patterns are rare, they can give out misleading signals. This is the reason why they are not popular among intraday traders. These patterns’ reliability might increase if the conviction from one more indicator can be drawn.

How to Trade with a Piercing Line Pattern?

You can always get trading assistance from technical indicators like candlestick charts. The piercing line pattern signals an overall bullish reversal trend in markets or related stocks. However, you should be very cautious while using them for trading, as it can give misleading signals.

In a piercing line pattern, you can visually see that the second candle covers about half of the first candle for forming a piercing shape. The red candle may not get covered in its entirety, implying that bulls could not control the market completely and reverse complete losses of the first day.

If indicators like the relative strength index, stochastic index and moving average convergence and divergence also give out buying signals, it indicates that the prevailing uptrend shall continue.

You can also take a long position after the formation of the piercing line pattern. Apart from this, you shall also keep an eye on the total trading volume. If trading volume breaches the average trading volume of the past few days, it is another strong signal that the downtrend is likely to end.

What Are the Advantages and Limitations of Piercing Line Candlestick?

First, we will discuss the advantages associated with piercing line patterns. They are as follows:

- It is easy to interpret and visually identify this pattern. Therefore, even new traders can use this in their analysis.

- if you’re able to identify the pattern correctly, it means that you’re in for a favourable risk-reward ratio.

Now, we will shift our focus to limitations:

- It’s not a frequent pattern, hence it can provide a misleading signal to new investors. One can not only rely on this pattern and make trades.

Final Word

The piercing line candlestick represents a continuation of a bullish reversal pattern. It is important to note that you should analyse signals of other market indicators and compare them with results obtained from piercing line patterns to make the trade error-free.

Frequently Asked Questions

What is the bearish piercing pattern?

There are two candles in the structure of a bearish piercing pattern. The second bearish candle shall open at a higher price point from the preceding bearish candlestick. However, it should close at a point below 50% of the opening candle.

What do you get to know from piercing patterns?

The piercing pattern is a bullish reversal indicator. The strength trend reversal can be gauged from a distance between bullish and bearish candlesticks. The more the distance, the stronger the strength of trend reversal will be.

What is a bullish piercing pattern?

A bullish piercing candle does not have any upper shadow and occurs after the end of a downtrend. Under this, price points pierce through the resistance levels formed in prevailing trends.